Bitcoin’s (BTC) price tanked to a 52-week low of $20,800 earlier on Wednesday, down by over 70% from its all-time high of $68,788. Although the price has since recovered above $21,000, key market indicators point toward bears having a significant hold on the current market.

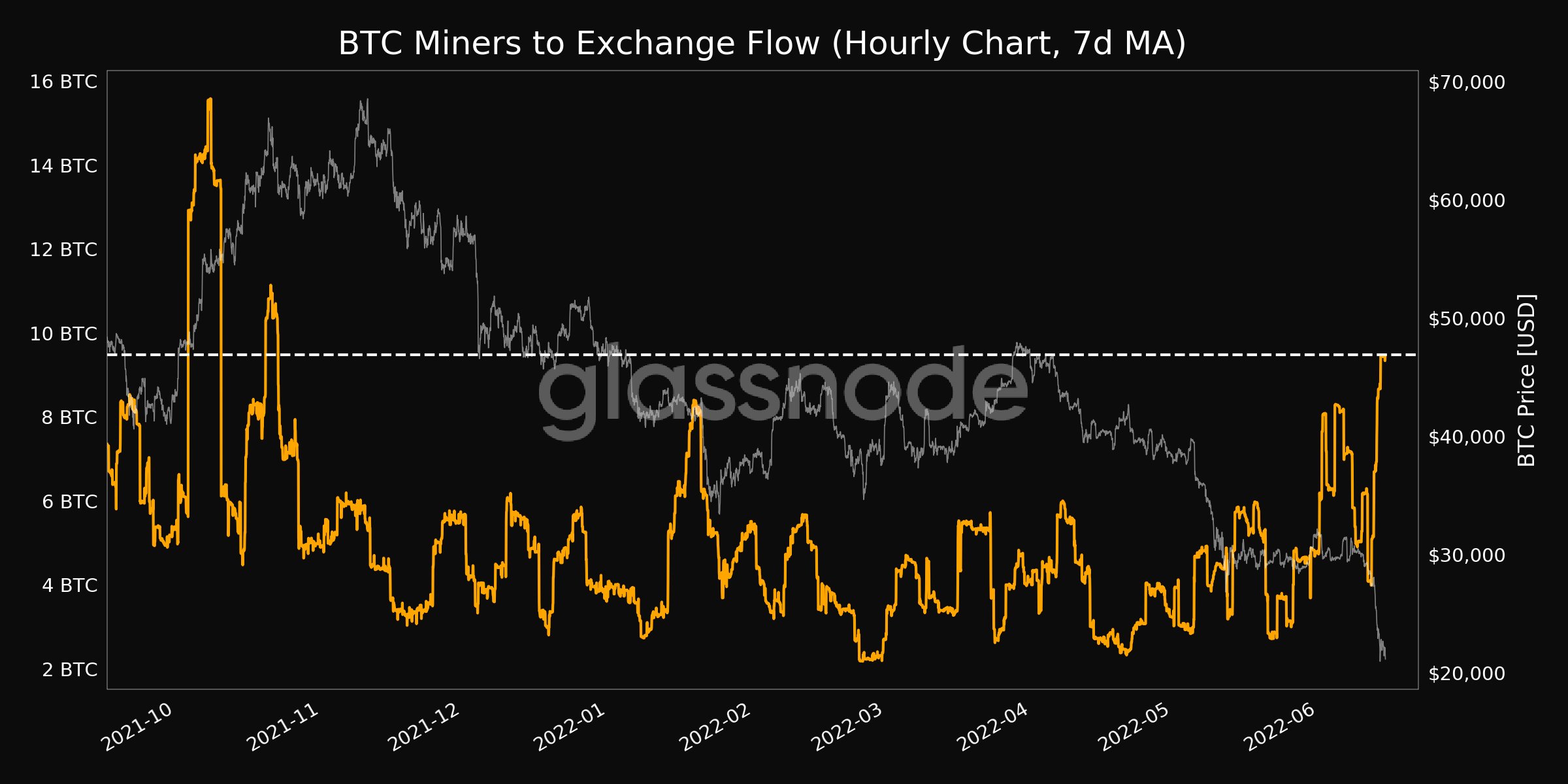

Bitcoin Miners to Exchange flow, a metric that indicates the volume of BTC sent by miners to crypto exchanges, rose to a seven-month high of 9,476. The rise in exchange flows indicates miners are currently selling their BTC in anticipation of the price going down.

The actions of the BTC miners often reflect the larger market sentiment as they mostly sell BTC to ensure they don’t incur losses on their mining rewards. The rise in Bitcoin miners selling activity is backed by the significant decline in mining profitability.

Related: Biggest Bitcoin exchange inflows since 2018 put potential $20K bottom at risk

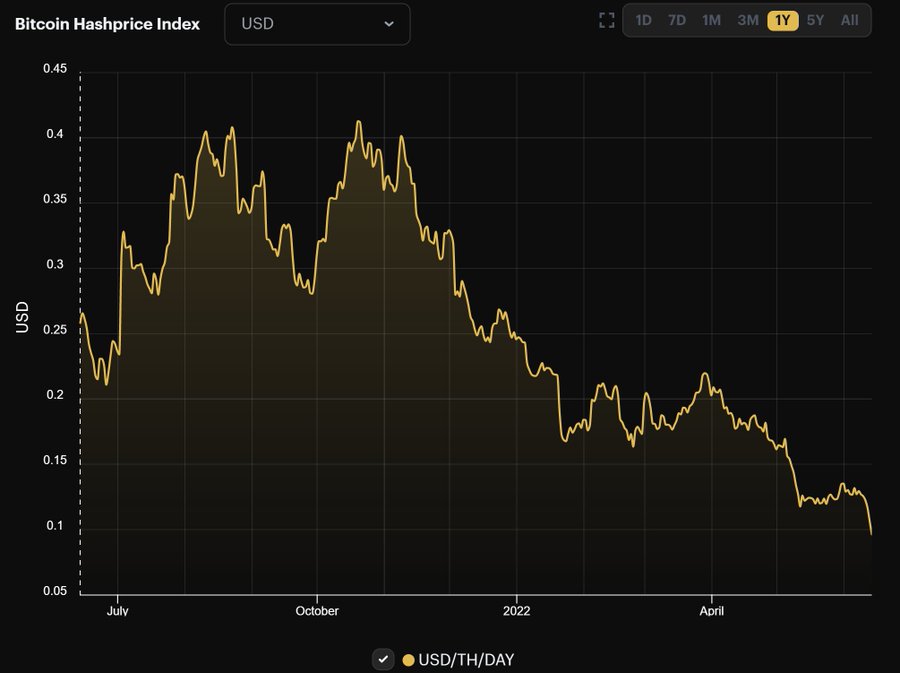

Mining profitability has dropped over 75% from the top, and Bitcoin’s hash price currently sits at $0.0950/TH/day, which is the lowest point since October 2020.

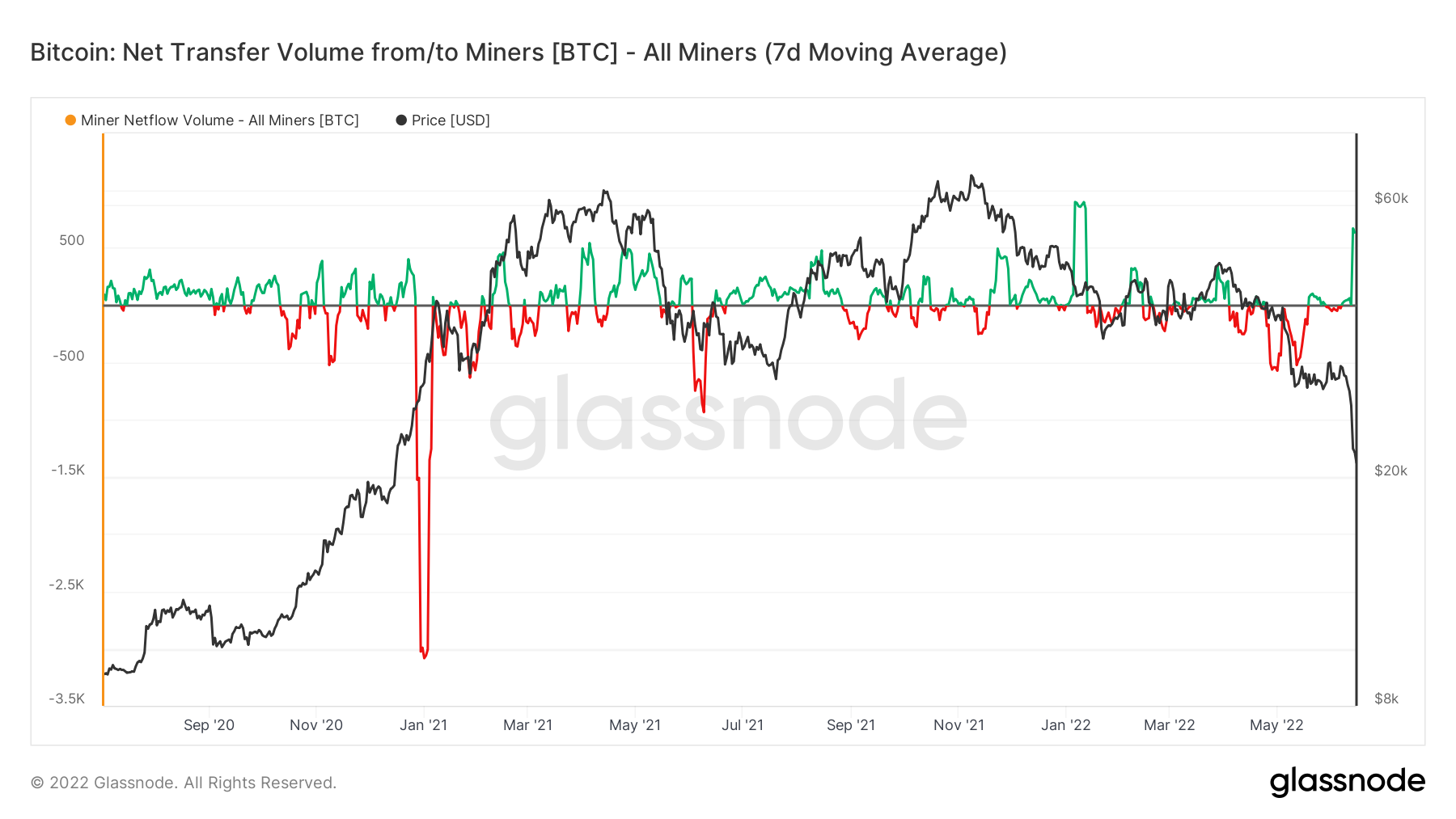

The miner netflow to exchanges has also turned positive. When the miner netflow is positive, it signifies that more coins are being sent to exchanges than are being sent to personal wallets. Such behavior would indicate that miners are bearish on the price and are under pressure to sell.

Many BTC mining rigs have turned unprofitable with the price dropping below $21,000 and risk being shut down if the price doesn’t recover. The rest of the crypto market followed BTC in its price action as the overall market cap dipped below $1 trillion.

Over the course of the past decade, BTC has seen numerous bull cycles followed by an 80%-90% decline from the top. However, the BTC price has never fallen below the all-time high of the previous cycle. Currently, BTC is trading very close to its 2017 high of $19,783, and any possible sell-off from here could push it to 2017 territory.