Bitcoin (BTC) dropped volatility on the last weekend of July as the monthly close drew near.

200-week moving average in focus for July close

Data from Valideapp Markets Pro and TradingView showed BTC/USD retaining $24,000 as resistance into July 30.

The pair had benefitted from macro tailwinds across risk assets in the second half of the week, these including a flush finish for United States equities. The S&P 500 and Nasdaq Composite Index gained 4.1% and 4.6% over the week, respectively.

With off-speak trading apt to spark volatile conditions into weekly and monthly closes thanks to thinner liquidity, however, analysts warned that anything could happen between now and July 31.

“Just gonna sit back and watch the market up until the weekly close like always,” Josh Rager summarized.

“Hard to get into any trades seriously though they may be a few outliers in current market condition that continue to perform well over the weekend.”

Others focused on the significance of current spot price levels, which lay above the key 200-week moving average (MA) at $22,800. Finishing the week above that trendline would be a first for Bitcoin since June.

#BTC is very close to performing a Weekly Close above the 200-week MA

Technically, it looks like BTC is doing well to reclaim the 200-week MA as support$BTC #Crypto #Bitcoin pic.twitter.com/ue00XDT9O0

— Rekt Capital (@rektcapital) July 29, 2022

Adopting a conservative short-term view, however, popular trader Roman called for a return to at least $23,000 thanks to “overbought” conditions.

$BTC H4

So far seeing deviation for the potential double top call from yesterday.

PA – vol down / price up is bearish. MACD rolling over. RSI overbought.

I expect a pullback to 23k at minimum. DT confirms on a close below 20.7k.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/aOahZDdYyC

— Roman (@Roman_Trading) July 29, 2022

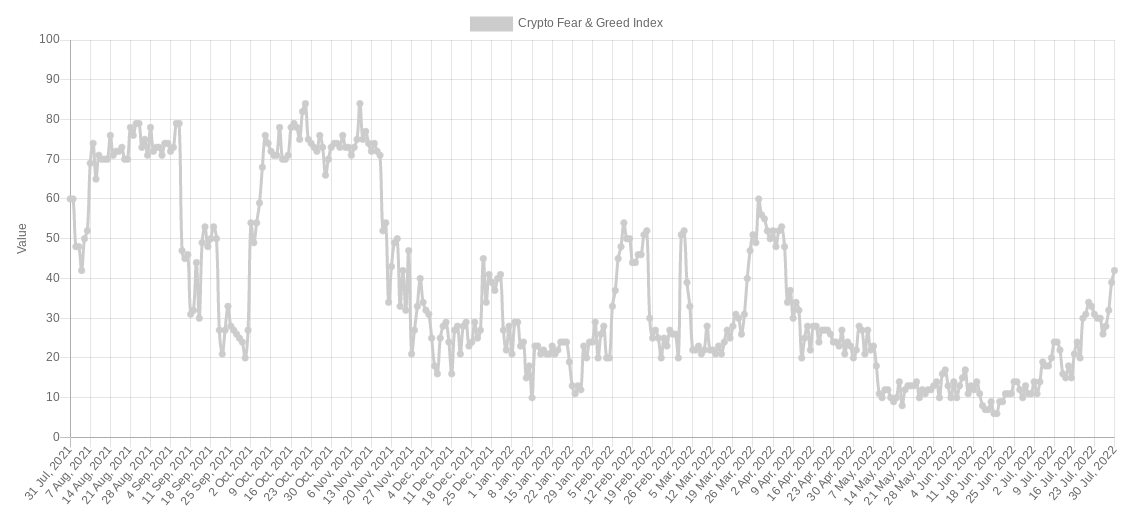

Optimism continued to increase across crypto markets through the week, the Crypto Fear & Greed Index hitting its highest levels since April 6 after exiting its longest-ever period of “extreme fear.”

At 45/100, the Index was officially in “neutral” territory on the day.

Bullish continuation slated for Au

Looking to next month, meanwhile, Valideapp contributor Michaël van de Poppe said that stocks performance would continue to provide fertile conditions for a crypto rebound.

Related: Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

“Sounds like we’re going to get that continuation in August, including with crypto and Bitcoin,” part of a Twitter update on July 29 stated.

“Summer relief rally it is!”

August was set to be a quiet month for U.S. macro triggers, with the Federal Reserve not due to alter policy in a scheduled manner until September.

The risk of advancing inflation nonetheless remained, with the next Consumer Price Index (CPI) print due August 10. This week, the European Union reported its highest-ever monthly inflation estimate for the Eurozone at 8.9%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Valideapp.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.