After the rising wedge formation was broken on Aug. 17, the total crypto market capitalization quickly dropped to $1 trillion and the bulls’ dream of recouping the $1.2 trillion support, last seen on June 10, became even more distant.

The worsening conditions are not exclusive to crypto markets. The price of WTI oil ceded 3.6% on Aug. 22, down 28% from the $122 peak seen on June 8. The United StatesTreasuries 5-year yield, which bottomed on Aug. 1 at 2.61%, reverted the trend and is now trading at 3.16%. These are all signs that investors are feeling less confident about the central bank’s policies of requesting more money to hold those debt instruments.

Recently, Goldman Sachs chief U.S. equity strategist David Kostin stated that the risk-reward for the S&P 500 is skewed to the downside after a 17% rally since mid-June. According to a client note written by Kostin, inflation surprises to the upside would require the U.S. Federal Reserve to tighten the economy more aggressively, negatively impacting valuations.

Meanwhile, extended lockdowns supposedly aimed at containing the spread of COVID-19 in China and property debt problems caused the PBOC led the central bank to reduce its five-year loan prime rate to 4.30% from 4.45% on Aug. 21. Curiously, the movement happened a week after the Chinese central bank lowered the interest rates in a surprise move.

Crypto investor sentiment is at the edge of ‘neutral-to-bearish’

The risk-off attitude brought by surging inflation led investors to expect additional interest rate hikes, which will, in turn, diminish investors’ appetite for growth stocks, commodities and cryptocurrencies. As a result, traders will likely seek shelter in the U.S. dollar and inflation-protected bonds during periods of uncertainty.

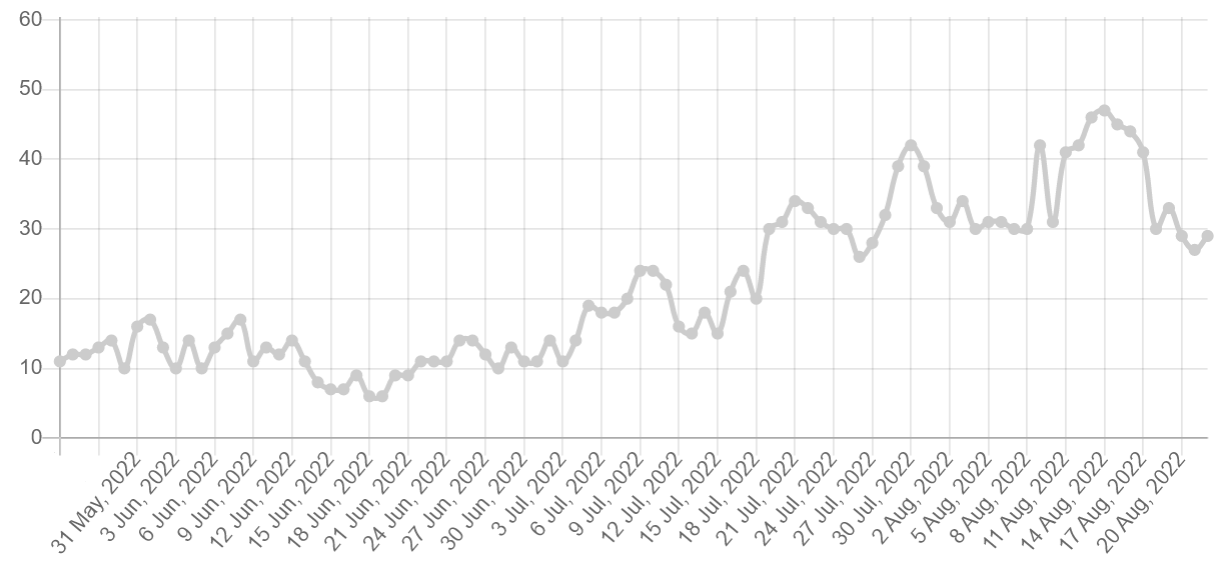

The Fear and Greed Index hit 27/100 on Aug. 21, the lowest reading in 30 days for this data-driven sentiment gauge. The move confirmed investors’ sentiment was shifting away from a neutral 44/100 reading on Aug. 16 and it reflects the fact that traders are relatively fearful of the crypto market’s short-term price action.

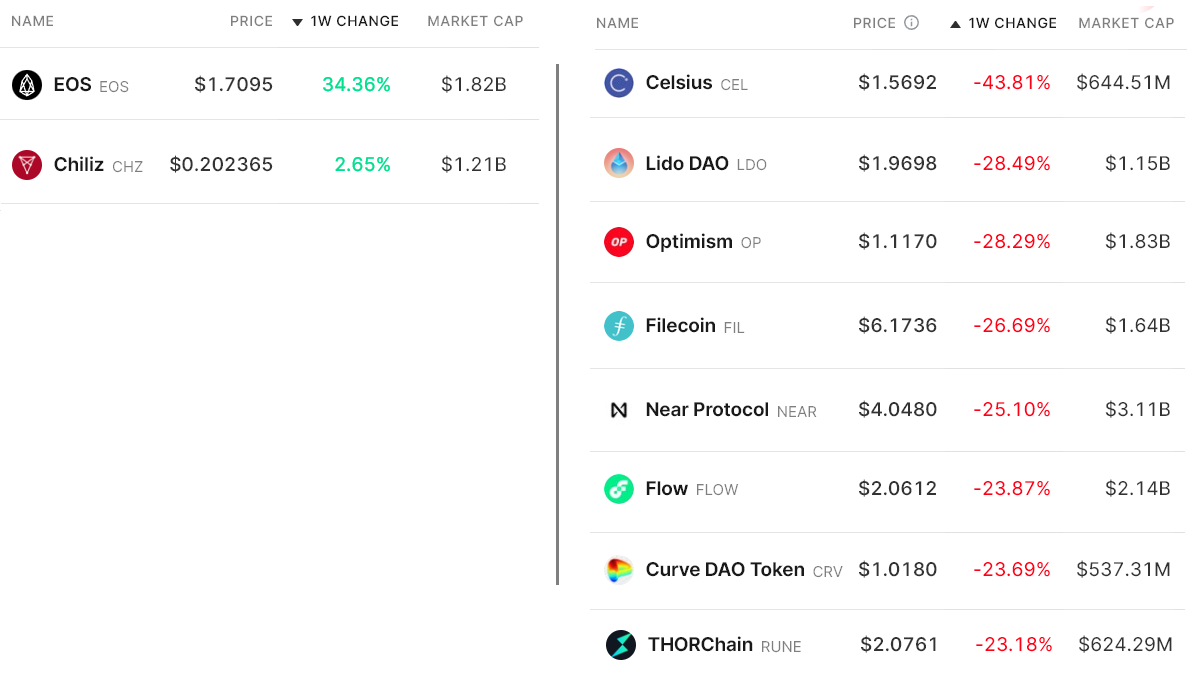

Below are the winners and losers from the past seven days as the total crypto capitalization declined 12.6% to $1.04 trillion. While Bitcoin (BTC) presented a 12% decline, a handful of mid-capitalization altcoins dropped 23% or more in the period.

EOS jumped 34.4% after its community turned bullish on the “Mandel” hard fork scheduled for September. The update is expected to completely terminate the relationship with Block.one.

Chiliz (CHZ) gained 2.6% after Socios.com invested $100 million for a 25% stake in the Barcelona Football Club’s new digital and entertainment arm.

Celsius (CEL) dropped 43.8% after a bankruptcy filing report on Aug. 14 displayed a $2.85 billion funds mismatch.

Most tokens performed negatively, but retail demand in China slightly improved

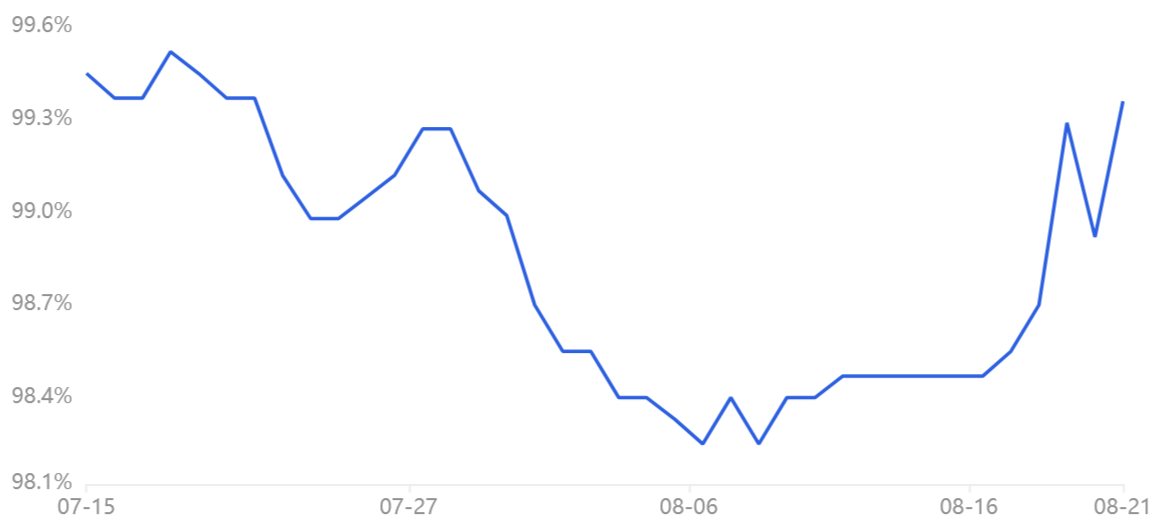

The OKX Tether (USDT) premium is a good gauge of China-based retail crypto trader demand. It measures the difference between China-based peer-to-peer (P2P) trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether’s market offer is flooded and causes a 4% or higher discount.

On Aug. 21, the Tether price in Asia-based peer-to-peer markets reached its highest level in two months, currently at a 0.5% discount. However, the index remains under the neutral-to-bearish range, signaling low demand from retail buying.

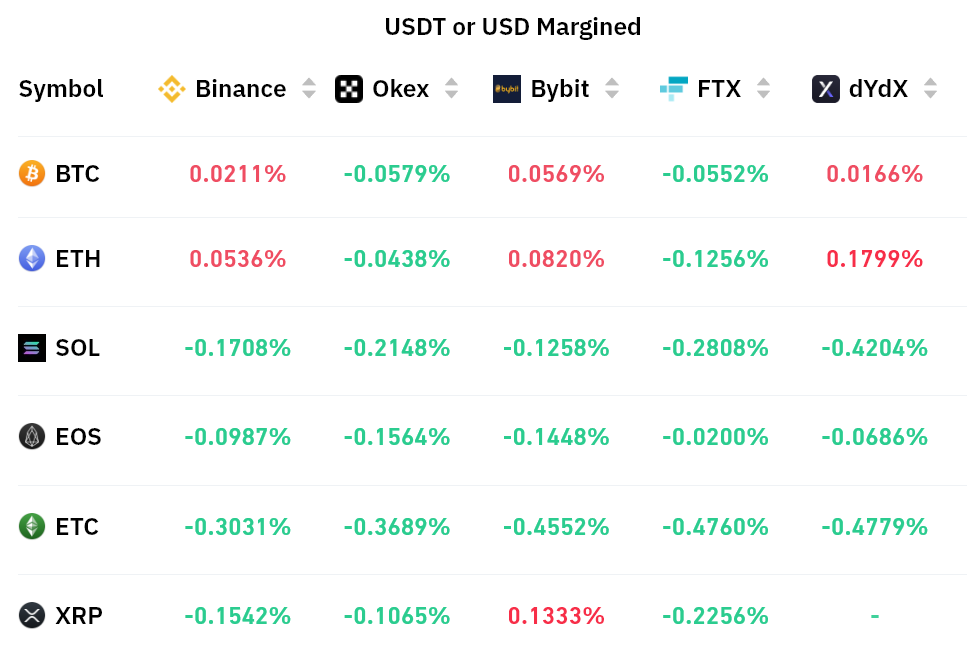

Traders must also analyze futures markets to exclude externalities specific to the Tether instrument. Perpetual contracts, also known as inverse swaps, have an embedded rate usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

Perpetual contracts reflected a neutral sentiment after Bitcoin and Ether held a relatively flat funding rate. The current fees resulted from a balanced situation between leveraged longs and shorts.

As for the remaining altcoins, even the 0.40% weekly negative funding rate for Ether Classic (ETC) was not enough to discourage short sellers.

A 20% drop to retest yearly lows is likely in the making

According to derivatives and trading indicators, investors are moderately worried about a steeper global market correction. The absence of buyers is evident in Tether’s slight discount when priced in Chinese yuan and the near-zero funding rates seen in futures markets.

These neutral-to-bearish market indicators are worrisome, given that total crypto capitalization is currently testing the critical $1 trillion support. If the U.S. Federal Reserve effectively continues to tighten the economy to suppress inflation, the odds of crypto retesting yearly lows at $800 billion are high.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Valideapp. Every investment and trading move involves risk. You should conduct your own research when making a decision.