Bitcoin’s (BTC) spot trading below $20,000 is seeing a new “capitulation” event encompassing an entire year’s worth of buyers, research reveals.

In one of its Quicktake market updates on Sept. 29, on-chain analytics platform CryptoQuant flagged intense selling by a large number of recent hodlers.

2021 bull market coins “have been sold aggressively”

As BTC/USD lingers near levels barely seen since 2020, it is not just miners feeling the pinch.

Analyzing Bitcoin’s Exchange Inflow Spent Output Ages Bands (SOAB), CryptoQuant contributor Edris showed that those who bought between April 2021 and April 2022 have been selling coins en masse — for less than they bought them.

“Looking at the chart, it is evident that coins aged between 6–18 months ago have been sold aggressively recently,” he concluded.

“These coins have been bought between April 2021 and April 2022 at prices above $30K. This signal means that many holders who have entered the market during the 2021 bull market and above the $30K mark, have recently capitulated and exited the market at an approximate 50% loss.”

Such events should not be taken lightl because they tend to occur at the bottom of bear markets. The only question is whether the recent macro bottom in June at $17,600 will be this one’s floor.

Edris added:

“These types of capitulations tend to occur during the last months of a bear market, pointing to a potential bottom formation in the near future.”

Profit warning meets profit potential

Investigating Bitcoin’s Spent Output Profit Ratio (SOPR) metric, meanwhile, fellow CryptoQuant contributor Caue Oliveira highlighted another historical bear market trend repeating itself.

Related: Bitcoin price due ‘big dump’ after passing $20K, warns trader

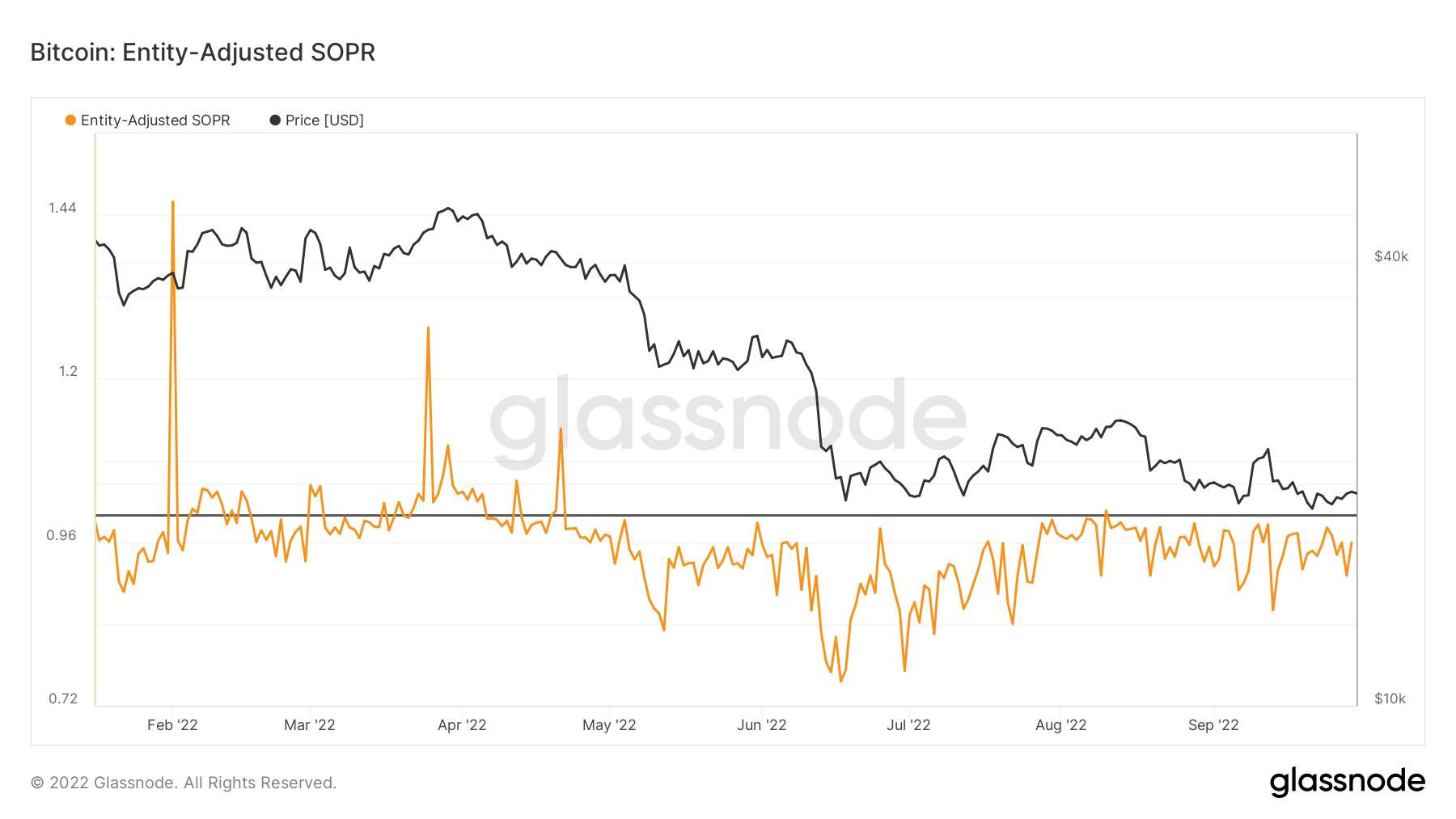

SOPR divides the price paid for an amount of BTC by the price it is sold at. The resulting figure fluctuates around 1, with values below indicative of a bear market as investors begrudgingly shoulder net losses.

According to data from fellow on-chain analytics firm Glassnode, as of Sept. 29, entity-adjusted SOPR was just over 0.95.

The metric is trending back towards 1, having seen a local bottom in June, suggesting that the prime buying opportunity may have already hit.

“Looking at the on-chain spending pattern of long-term holders, measured through the Spent Output Profit Ratio… we can find the biggest selling points at a loss,” Oliveira wrote.

“Historically these points have been the best risk-adjusted entries in the last two bear market floors.”

Looking ahead, a “maximum pressure point” for long-term holders (LTHs) is on the cards, he added, referencing selling pressure decreasing as SOPR inches higher.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Valideapp.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.