This article was originally published by Pierre on TheGreatResetFilms.com

In the 18th century, the Dutch introduced the concept of mutual funds, allowing investors to diversify between different international bonds.

The same concept was embraced in London in the 19th century. This concept is what allowed companies like F&C Asset Management to be funded in 1868.

Why? F&C managed a portfolio of high-yielding international bonds, which pushed forward the concept of portfolio diversification, with the idea that putting together different securities lowered the risk of the portfolio. This is true in financial theory, and anyone who has a higher education in finance surely worked on building different models around that. At the time, though, they believed that adding any kind of additional asset into a portfolio lowered its risk – we now know that is not the case.

Of course, London, at the time, was where the money was at. After beating France during the Napoleonic Wars (1), the U.K. established its position as the world’s strongest empire and spread the British Pound across the world. This diversification theory was a great reason to invest in the entire world. Stock exchanges started sprouting all over the world and were a sign of a developed capital city. “Between 1880 and 1910, more than half the world’s markets were launched” (William N. Goetzmann).

The British Empire was far-reaching and majestic, but after World War I, World War II and the multiple bankruptcies within this period, it had to move aside and let another strong power take over: the United States.

The U.S. has grown its influence in a similar fashion:

- This is where the money was at

- Leveraging international markets and international investments

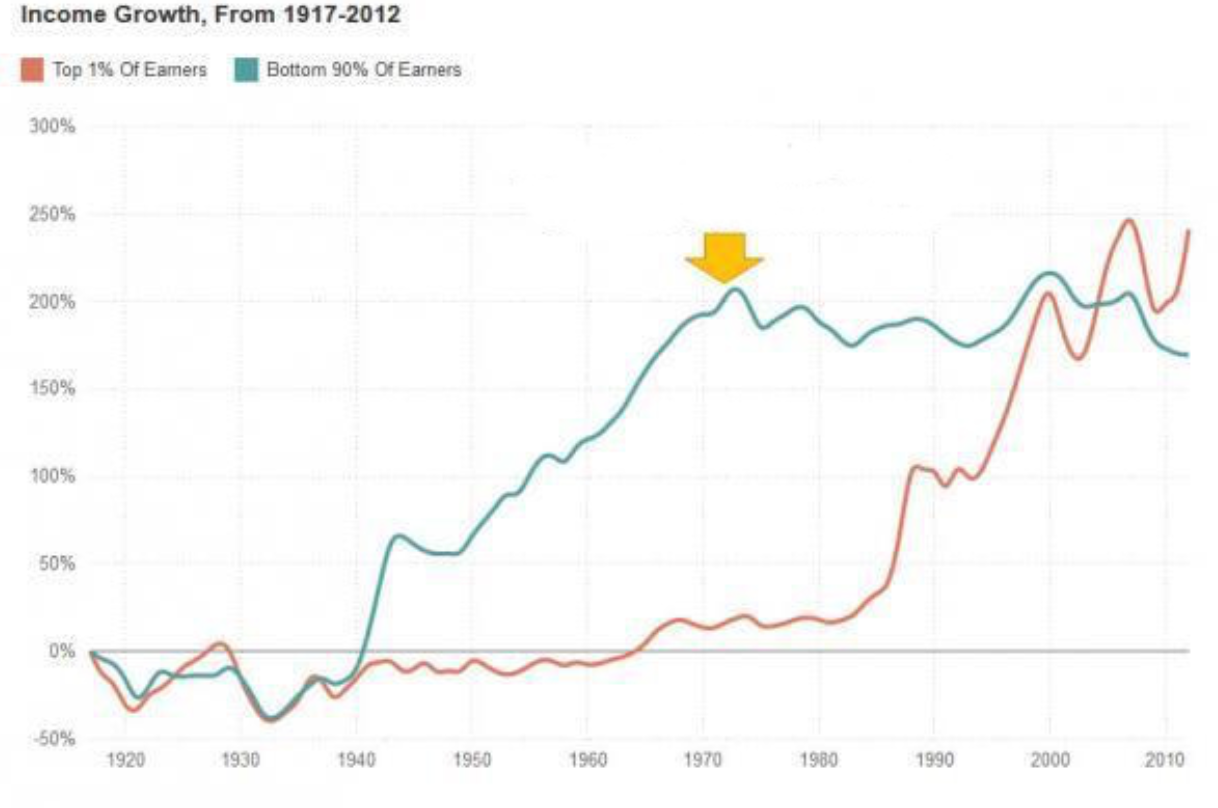

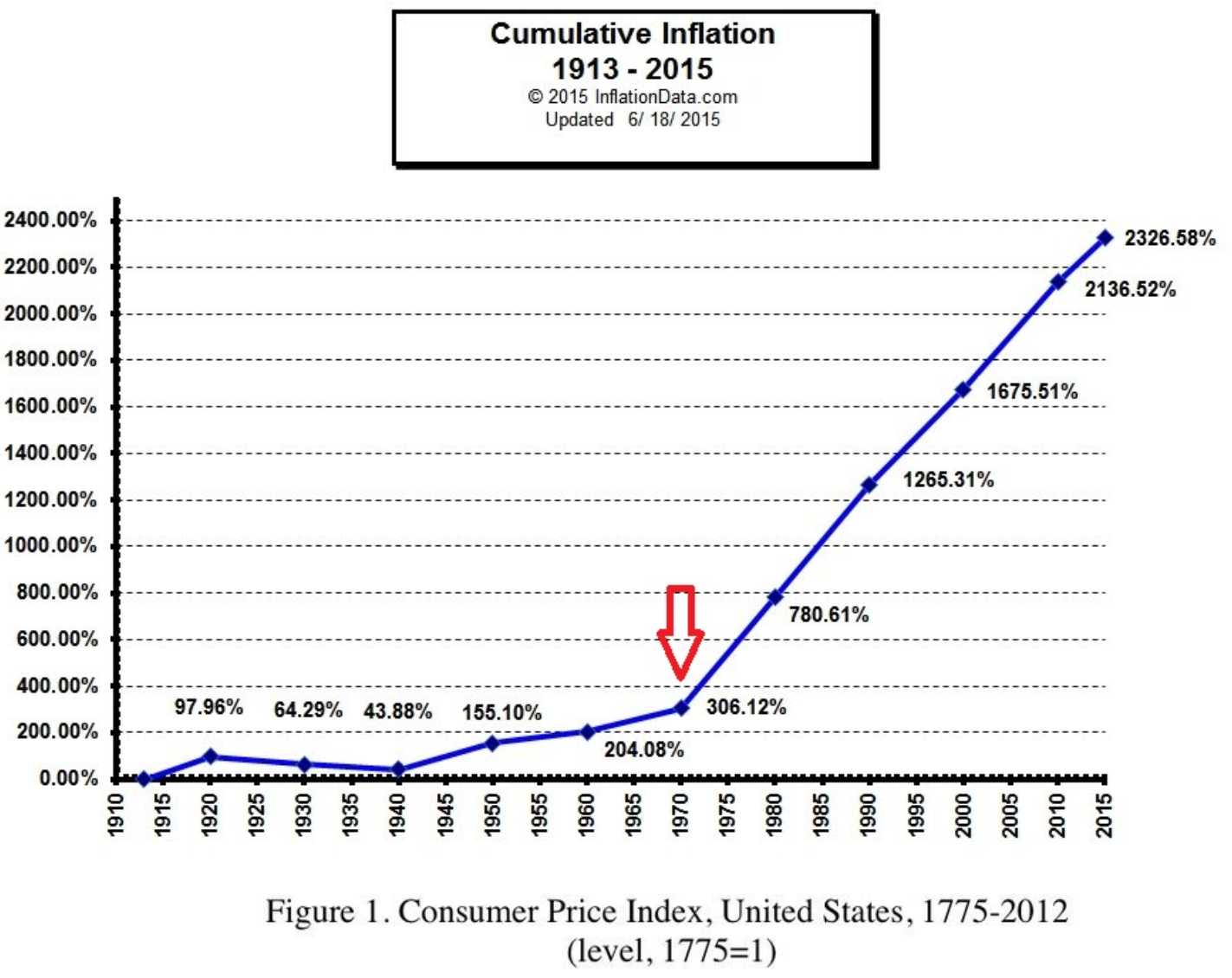

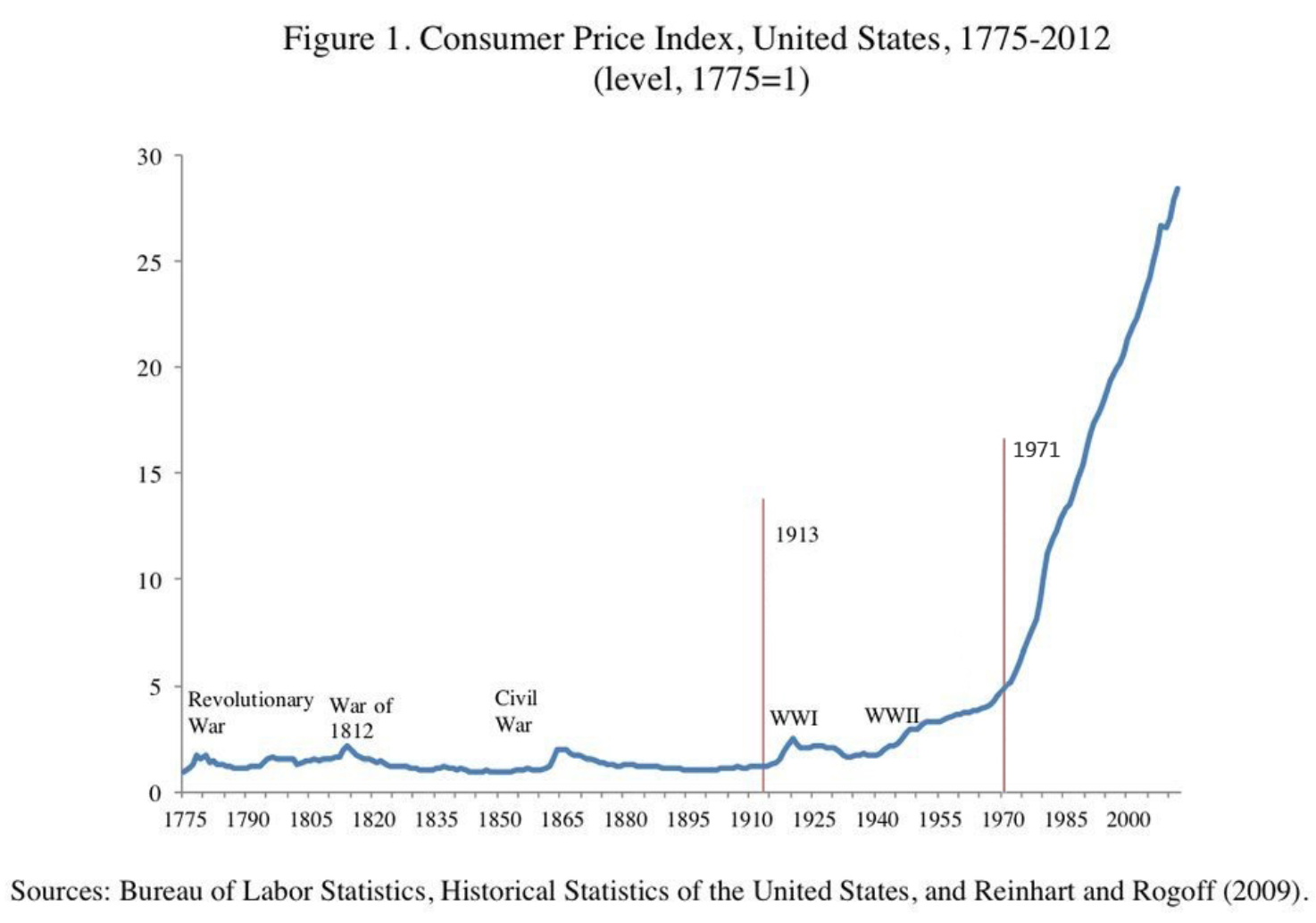

The U.S. dollar was at the center of this expansion, and the U.S. was in control of the currency, giving them huge leverage over the rest of the world. Since then, time and time again, the United States has used military power to establish and to defend the status of the U.S. dollar. We’ve seen this in Iraq (2) and other international conflicts. The U.S. has to defend the status of the U.S. dollar, because without the status of global reserve currency, the U.S.’s status quo is at risk and may have big impacts on the U.S. economy and its citizens, or at least this is what seems to have always been believed by U.S. leaders. The fact is that in trying to keep its status and the system created as a result of the Bretton Woods agreement, the U.S. leaders have slowly destroyed the value of the U.S. dollar and have impoverished their citizens along the way. There are some clear charts that illustrate this long-term phenomenon that can be viewed here.

This, of course, is not only a U.S. phenomenon, but has been true for the rest of the world, too. Through the use of the petrodollar, the eurodollar and the U.S. dollar being the global reserve currency, every other currency has been devalued faster than the U.S. dollar, leading to the same effects, if not worse, everywhere else. A lot of these points are covered in my film “The Great Reset and the Rise of Bitcoin(BTC)” (3).

Today, it seems like we are at a shifting point. The fight for the U.S. dollar is going strong in Europe, precisely in Ukraine. The headlines of the entire world focus only on the conflict, but omit to mention what is happening in the background, at the risk of exposing the real geopolitical plays. The BRICS have given more than clear hints about their mid- to long-term opinion about the future of the U.S. dollar. They have officially announced that they are building a new reserve currency based on real hard assets, which include a few precious metals (4), further forcing the U.S. to try and strengthen their position as the “world police” they have been for a while. We are seeing this through the influence that was used following the outcome of the presidential elections in Pakistan (5) and the position they are trying to take in the China-Taiwan relationship (6).

On another continent, the fight for the U.S. dollar is also happening. Central America has always been under big influence from the United States; Thomas Jefferson himself said “in whatever governments they end, they will be American governments, no longer to be involved in the never-ceasing broils of Europe. America has a hemisphere to itself.” (7) Meaning they would make sure European nations leave the region, so they can influence the region themselves.

A small country, historically destroyed by the U.S. and their overreach in the region, is trying to detach from the U.S. dollar it adopted in 2001, following the poor local monetary policy that was in place for decades. In September 2021, in a historic move, El Salvador, the smallest country in the region, was the first country in the world to adopt bitcoin as legal tender, sparking the fire that forced the U.S. government to set its eyes on the region again. Since then, El Salvador has become a more important topic in international media. Thanks to this move, El Salvador’s tourism has increased by 30% since the launch of the Bitcoin(BTC) Law (8), and as mentioned by their President Nayib Bukele, the El Salvador GDP grew 10.3% in 2021, the first year in their history to have a double digit GDP growth (9).

On the international scene, though, their relationships seem to have changed since the adoption of Bitcoin(BTC). The best sign of this is the Accountability for Cryptocurrency in El Salvador (ACES) Act (10), legislation introduced by U.S. senators Jim Risch (R-Idaho), Bob Menendez (D-N.J.) and Bill Cassidy (R-La.). The goal of this legislation is to allow the U.S. to monitor the adoption of bitcoin in El Salvador and take actions if they consider that it can represent a risk for the U.S. economy. As a reminder, the U.S. GDP in 2021 was $23 trillion, while the El Salvador GDP was $28.7 billion. This makes the El Salvador economy 1,000 times smaller than the one from the U.S. It seems like the goal of this legislation is not to mitigate the risks El Salvador represents to the U.S. economy, but to have a victim in case they consider bitcoin to be dangerous for the U.S. dollar.

Samson Mow, CEO of JAN3, described this the best here:

Another important point to note is the popularity of Nayib Bukele in the region. Adopting bitcoin comes with adopting better long-term values. He is among the most popular presidents in the history of his country and is the most popular president in Latin America (11).

Since the adoption of Bitcoin(BTC) in El Salvador, other countries in the region have considered adopting it too, but have slowed their adoption because of external pressure. Honduras is slowly moving forward, though, thanks to regions or cities acting independently in the hopes of attracting foreign investments and tourism.

The fight for the U.S. dollar that the U.S. government is on is a fascinating story. We are at a turning point in history, where the U.S. dollar could lose its status, and the U.S. government will do almost anything to defend its status. One of their actions in this direction is to censor bitcoin adoption in the world.

We’re working on a documentary project that will explore the actors that are trying to block bitcoin adoption in the world. Find out more here:

Sources:

- The Great Reset and the Rise of Bitcoin(BTC)

- pool%2C known as the,for a short-term crisis.

- Inevitable Revolutions: The United States in Central America, Walter LaFeber, 1983

- introduced the Accountability for,to the U.S. financial system.