Pinterest has published its latest performance update, with the platform seeing an increase in users in Q1, but a slowdown in revenue intake, as it continues to expand and diversify its monetization potential.

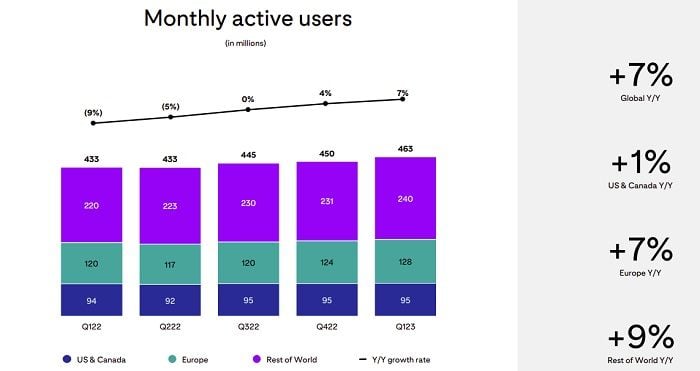

First off, on users – Pinterest added 13 million more users in the quarter, with its growth momentum accelerating in the new year.

It’s something of a return to form – Pinterest had seen a big jump in usage amid the pandemic, when lockdowns forced everybody to shop online, but it lost much of that growth as physical stores re-opened. Now, it’s clearly on a more positive trajectory once again, with users in more regions now also coming to the app.

Pinterest also says that it’s seeing more engagement, with sessions, impressions, and time spent growing faster than MAUs. And interestingly, Pinterest also notes that Gen Z is now its fastest growing demographic, another good sign for its future potential as a key discovery element.

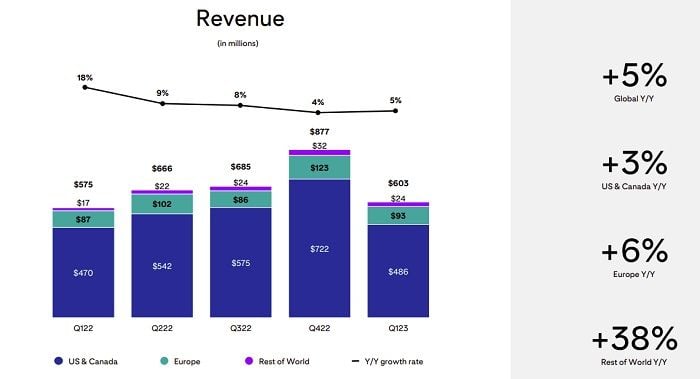

In terms of revenue, however, the story is not as great.

Pinterest brought in $603 million for the period, which is up year-over-year, but down on its 2022 results. Like all social platforms, Pinterest is dealing with the broader economic downturn, which has impacted ad spend, but the expanded usage does bode well for its future potential.

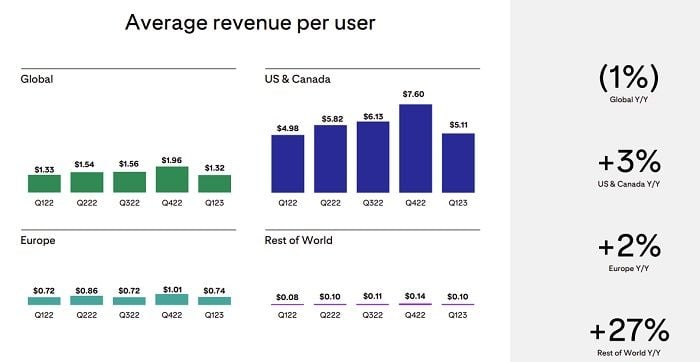

As does this chart:

Pinterest still has a way to go in maximizing its potential, with Pinterest ads still in the process of being made available in all regions. As it boosts its international presence, and with its product discovery focus, that should eventually see it drive more revenue from these regions, and the variance between North America and everywhere else does indicate significant growth potential in this respect.

But right now, the overall declines are not good, and the market will likely respond in kind.

In terms of key trends, Pinterest says that video content grew nearly 40% in the app in the period, reflecting the broader trend towards video across social platforms. Pinterest’s looking to help brands tap into this with improvements to its Idea Pins, along with the addition of new promotional options, like Premiere Spotlight, which enables brands to buy prime real estate o the Search tab.

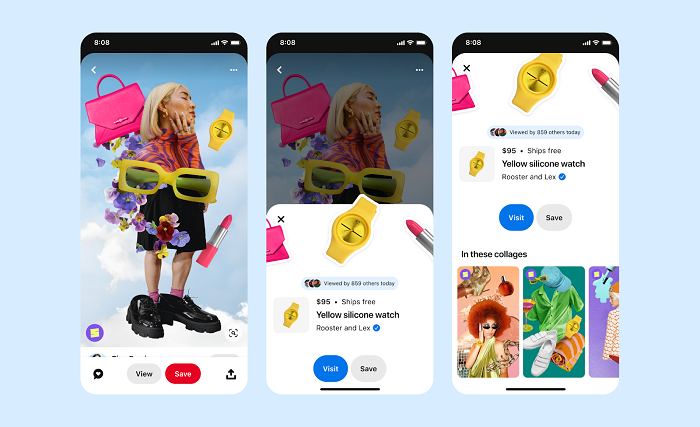

It’s also looking to provide more creative potential with its separate collage-focused Shuffles app, which has gained traction in several markets.

Pinterest recently made Shuffles available in more regions, and the stand-out visuals, which link back to Pins, have clearly resonated with younger audiences, forming part of its increased appeal with Gen Z consumers.

Overall, Pinterest is suffering from the same market conditions that have hurt the results of all social apps, which have forced mass lay-offs at Meta, Snapchat, Twitter and more. Pinterest also cut 150 staff in February, around 5% of its total workforce – yet even so, its sales, marketing and admin costs have still increased significantly year-over-year.

That could mean that more cuts are coming, and as the market responds to these numbers, I would assume that this will be a keen focus in Q2.