Snapchat has published its Q2 23 performance report, which shows an increase in overall users, especially in developing markets, as well as signs of recovery for Snap’s ad business, which now has more ad partners than ever, who are seeing improved optimization performance.

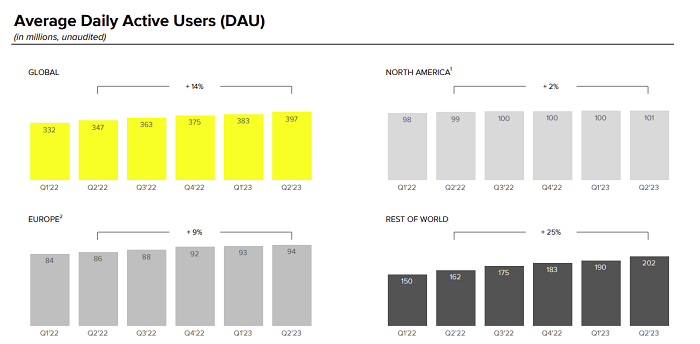

First off, on users, Snapchat added 14 million more daily active users (DAU) in Q2, taking it to 397 million DAU overall.

The majority of that growth is still coming from the ‘Rest of the World’ category, with Snap only adding a million more users in both North America and EU respectively. Snap added 12 million more users outside of its main markets, with the app continuing to see solid take-up in India, where mobile adoption and improving connectivity has opened up new opportunities for the app to reach this audience

Indeed, over the past year, Snap has added 40 million more users in the ‘Rest of the World’ category, while adding 10 million in the US and EU. Which bodes well for its future opportunities, though the immediate revenue benefits are not as significant.

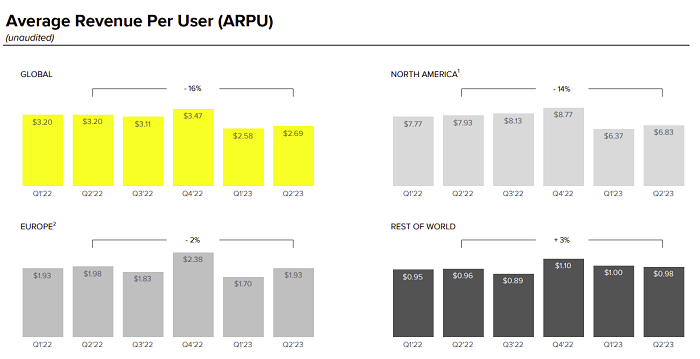

As you can see in these charts, Snap’s average revenue per user (ARPU) is far lower in that bottom right category, which means that while Snap is adding more users, its revenue is not growing at equivalent rates, though it is seeing some recovery in its ad business.

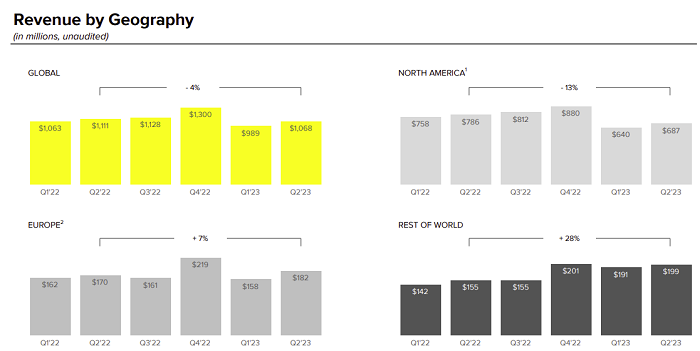

Snap’s overall revenue for Q2 comes in at just over a billion dollars, which is a decrease of 4% year-over-year, but an increase of 8% quarter-over-quarter.

Snap’s still recovering from the impacts of the shifting digital ad market, and the broader economic downturn, but it does note that it has seen improved performance in its ad tools, leading to stronger take-up over time.

“In Q2, we made progress toward improving results for advertisers through machine learning (ML) model updates and infrastructure improvements, new ways of measuring and optimizing advertising spend, and new leadership for our go-to-market efforts. We are pleased to see that this progress is beginning to translate into improved results with record active advertisers in Q2, up more than 20% year-over-year, and through improved advertiser retention compared to the same time period last year.”

So more advertisers are coming to the app, which also bodes well for future success, but it’s not quite translating into big dollars for the company right now, as it continues to build out its more advanced ad targeting tools, and re-shape its systems in light of evolving privacy and data restriction measures.

Snap was particularly impacted by Apple’s 1OS 14 update, which prompts users as to whether they want to share data with an app or not. Given Snap’s focus on user privacy, it’s unsurprising that a lot of Snap users opted out of sharing additional info, which has forced Snap to reform its ad targeting process.

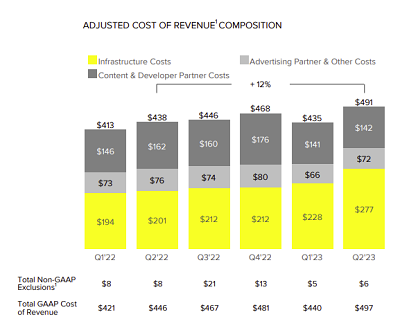

And that shift is also reflected in its outgoings.

Snap’s infrastructure costs jumped almost $50 million in the period, which also relates to AI and AR development, but this would also reflect the ongoing expense of transforming its ad targeting process, in order to better align with partner needs.

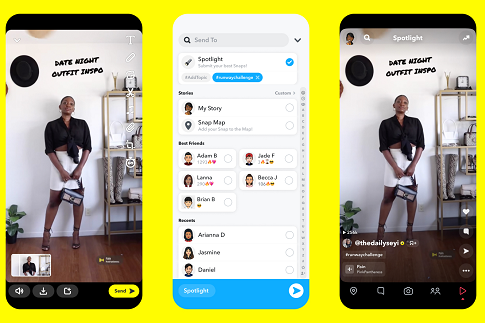

In terms of more specific elements, Snap says that total time spent watching Spotlight, its TikTok-like short-form video feed, has more than tripled year-over-year, reflecting the ongoing popularity of the format.

Snap says that Spotlight now reaches more than 400 million users each month, an increase of 51% year-over-year, which shows that while feature replication may seem like cheating, and a cheap tactic in the sector, there’s clear logic as to why each app looks to steal the best ideas from one another.

Snapchat+ has also continued to see strong take-up, recently reaching 4 million paying subscribers.

Snap has seen better success with Snapchat+ than Twitter has with Twitter Blue (est. 700k sign-ups), despite Twitter making a much bigger push on its offering, which reflects both the value that Snap provides to its dedicated user base, and the utility of the add-ons included in the Snapchat+ package.

Twitter Blue, which has sought to push verification ticks as its key value add, has become an increasingly divisive option, with Elon Musk’s fans happily paying up, and chastising those who refuse, as if the very action is a form of political statement. Snapchat+ has taken a more reserved approach, but the value that Snap provides has seen many users taking it up anyway, which is why S+ subscriptions are now almost six times higher than Blue usage.

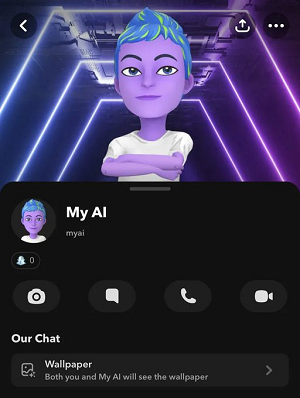

Snap’s also seen a lot of interest in its ‘My AI’ conversational chatbot, which began as a Snapchat+ exclusive, but is now available to all users.

“Since launching My AI, our AI-powered chatbot, over 150 million people have sent over 10 billion messages, which we believe makes My AI among the largest consumer chatbots available today. We are testing My AI monetization with sponsored links that connect our community with partners relevant to their conversation in that moment, while helping brands reach Snapchatters who have indicated potential interest in their offerings.”

Interest in generative AI continues to grow, and Snap’s been able to tap into this with this in-app element, which is clearly resonating with at least some segments of its community. Snap’s also added in visual elements to My AI, so users can generate responses from the tool based on visual cues, while it’s also working on generative visual tools, as an expansion of its AI features.

Snap still has some way to go in getting its ad business back on track, but the signs here are generally positive, with more users coming on in developing markets, and more advertisers trying out Snap’s improving ad offerings, which will likely lead to more revenue in future.

The concern is the cost of that revenue, and the jump in Snap’s infrastructure spend. That could be a once-off, as part of general investment in improving the platform, which will then facilitate more opportunities. But right now, in this quarter, that has impacted the overall numbers.