Snapchat has provided its latest update on regional user growth, with the announcement that it’s now up to 8 million monthly users in Australia, where it’s also seeing solid take-up among younger audiences.

As per Snap:

- Snapchat currently reaches 80% of 13-24 year olds and 75% of 13-34 year olds across Australia.

- While Snapchat is loved by Generation Z, almost 45% of Snapchatters in Australia are 25 years or older

- Australian Snapchatters open the app an average of 40 times per day – to chat with friends and family, watch highlights of their favorite shows, or share moments from their lives

- 60% of our Australian community interact with Augmented Reality (AR) Lenses on Snapchat daily, to express themselves creatively, have fun, and buy products from their favorite brands

The engagement notes are similar to what Snap’s seeing in other regions, with Snap also reporting back in June that it’s now up 15 million users in Germany, and 21 million in the UK.

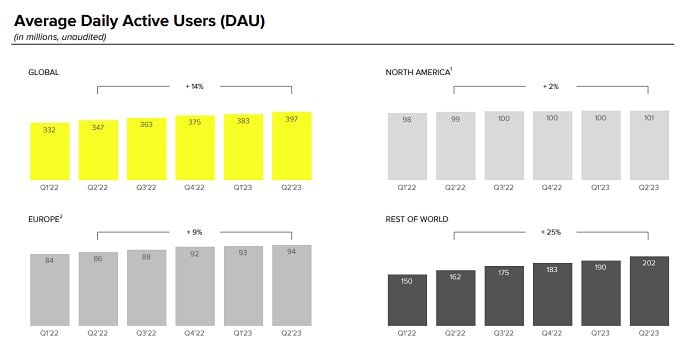

The regional breakdowns provide some more context on Snap’s broader usage numbers, which also show that its total North American usage (U.S. and Canada) is currently at 101 million (daily actives).

Though as you can see in these charts, its growth has slowed significantly in the North American and EU markets, with the majority of Snapchat’s growth now coming in the ‘Rest of the World’ category, with more Indian users, in particular, coming online as connectivity evolves in the region.

As you can see in this chart, India is now Snap’s single biggest user market, seeing double the usage of the North American region.

And while daily and monthly usage stats are not directly comparable, at 383 million DAU, and over 750 million total MAU, extrapolation of the available data would suggest that Snapchat currently has around:

- 190 million MAU in North America

- 180 million MAU in EU

- Around 380 million in other regions (inc. 200 million in India)

Australia, of course, would be in the ‘Rest of World’ category as well, and it’s interesting to note the regional usage stats, and the specific engagement notes, which could relate to your campaigns.

Essentially, Snap engagement remains very high among teen users, while the app’s seeing more growth in the Asia Pacific than anywhere else, with India now leading the way.

We’ve come a long way from Snapchat CEO Evan Spiegel refusing to expand into India, after reportedly telling employees that the app wasn’t made for ‘poor countries’.

Snap’s 2018 re-alignment has changed the trajectory of the app in this respect, and it’ll be interesting to see whether it can generate more revenue from Asia Pacific users in future.