More people are spending more money in apps, while users are also spending more of their time on social, even if they’re not posting as many updates themselves.

These are some of the findings from data.ai’s latest “State of Mobile” report, which looks at how apps across each consumer category performed in 2023, and where the data.ai team predicts they’ll be headed over the next year.

You can download the full 103-page report here (with e-mail sign-up), but in this post, we’ll take a look at some of the key highlights.

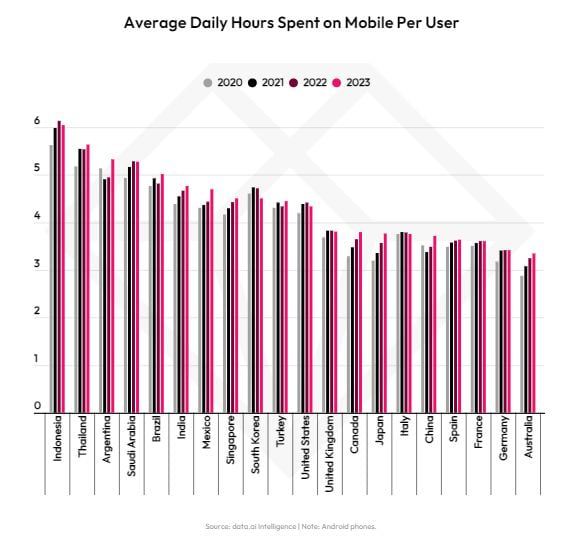

First off, the report looks at our rising reliance on apps and mobile connection, with the average time spent on mobile rising to 5 hours per person per day on average in 2023, a 6% increase from 2022.

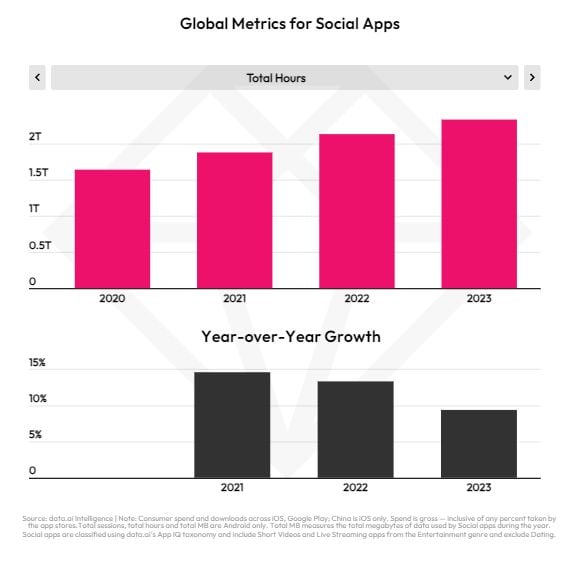

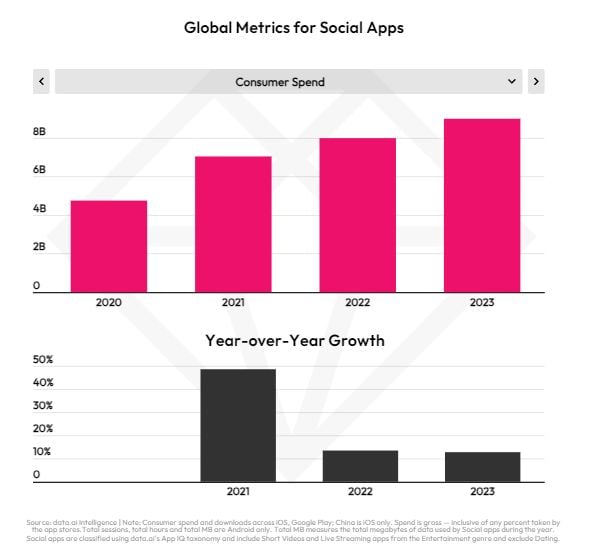

And social media apps are a big part of this, with the total hours we spend on social platforms also increasing, though at a slower rate than previous years.

Which is interesting considering the shift in user behavior, and the gradual move away from posting our own personal updates to social apps.

Various reports have also shown that people are posting fewer updates to social feeds, with more engagement activity switching to DMs. So while we are spending more time on social, more of that time is seemingly going to entertainment, as opposed to what we would traditionally deem “social” activity.

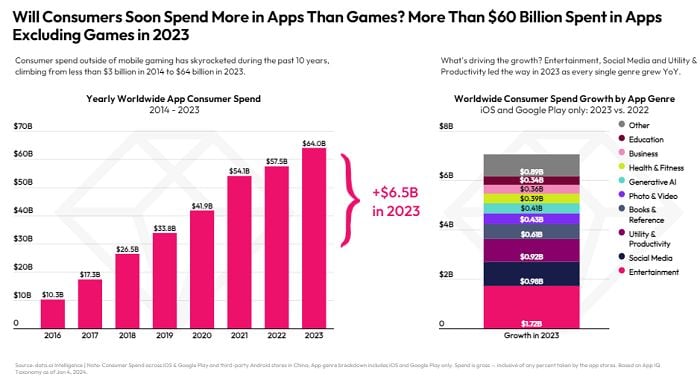

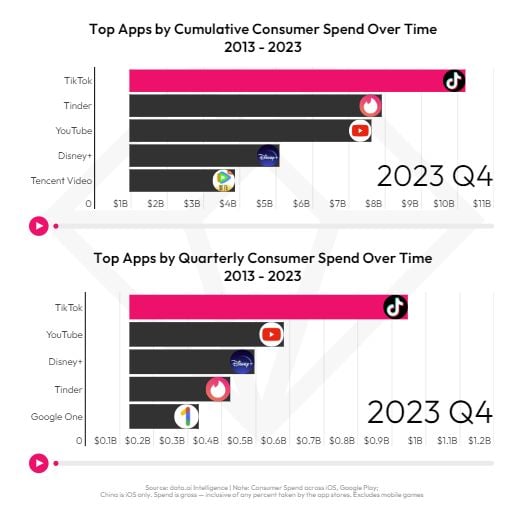

On another front, spending in apps is also on the rise, with overall consumer spend surpassing $60 billion in 2023.

As you can see in these charts, both “Entertainment” and “Social media” spending significantly rose throughout the year, as more platforms introduced new ways to monetize their respective audience.

But the leader on this front is clearly TikTok:

As per data.ai:

“TikTok became the first app ever – including games – to reach $10 billion in all-time consumer spend. This milestone seemed impossible only a few years ago. It took nearly 10 years for any non-game app to accumulate just $1 billion in all-time consumer spend. TikTok is now surpassing $1 billion in consumer spend each quarter.”

The report further notes that the vast majority of TikTok’s in-app purchase revenue comes from coins which can be used to tip creators during live streams.

Interestingly, TikTok hasn’t been able to merge this behavior over to in-stream shopping as yet, but given its overall monetization performance, you can see why TikTok is so keen to expand on this, and get more users spending more money in app.

And if it can do so, that’ll present a massive opportunity.

If any app was close to becoming an “everything app” in the Western market, it’s likely TikTok, which would no doubt rings alarm bells for those concerned about Chinese app influence.

The report also looks at the top performing social apps by market:

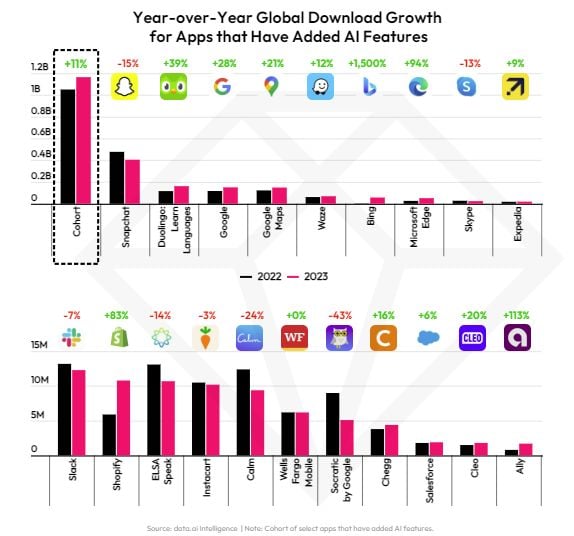

As well as the rise of generative AI, and how that’s also driven more interest in certain apps:

Microsoft’s Bing search engine, a largely ignored Google competitor, saw downloads rise by 1,500%, based on the addition of ChatGPT elements.

Clearly, consumer interest in generative AI is on the rise, which points to the transformative impact of AI in the discovery process.

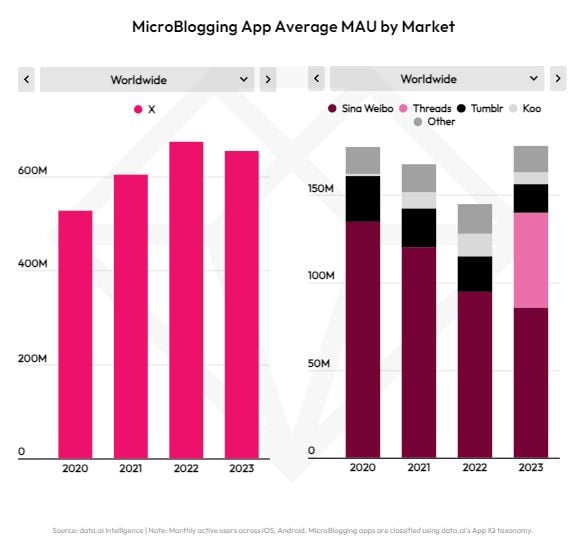

The report also provides some brief notes on the decline of X, which saw a dip in usage in 2023.

That runs counter to Elon and Co.’s repeated claims that X is actually growing, and doing better than ever. External reporting doesn’t show that, though Elon has also changed the very definition of success, by switching to new metrics to measure user engagement.

data.ai’s report covers a broad range of app categories and trends, and provides some interesting insights to consider for where things are headed.

If you’re interested in getting a better understanding of the latest consumer shifts, you can download the full “State of Mobile 2024” report here.