Meta has published its Q4 2022 and full-year earnings results, posting another increase in active users, and steady, if not amazing, revenue results.

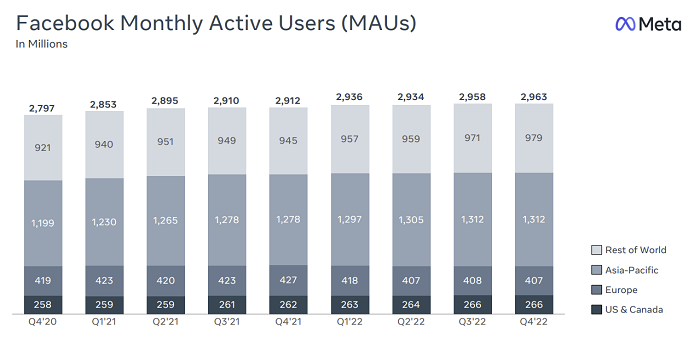

First off, on active users – Facebook’s monthly active user count rose to 2.96 billion in the quarter, a slight increase on Q3.

Though as you can see, there are some concerning signs there, with Facebook growth remaining essentially flat in every market except the ‘Rest of the World’ bracket.

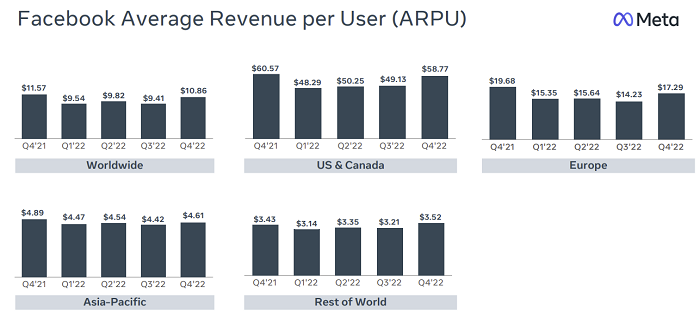

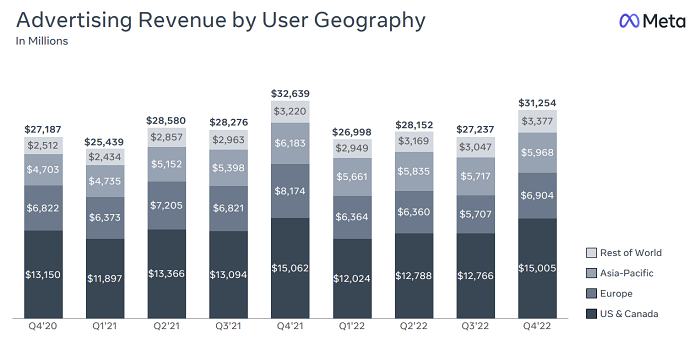

That doesn’t bode well for the revenue potential of Facebook specifically, because as you can see in these next charts, while reaching more users provides more opportunities, they’re not big earners for the company as yet.

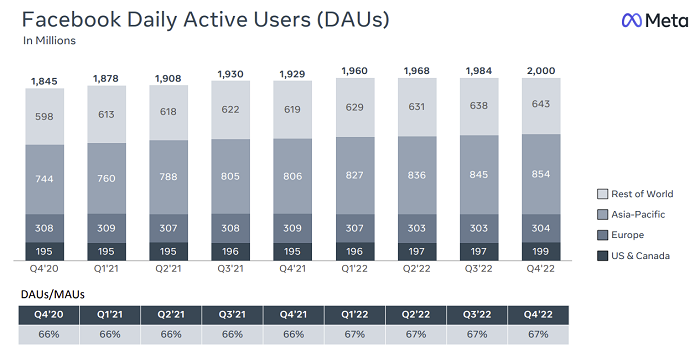

Facebook’s daily active figures are much the same – largely stagnant, though people in the Asia Pacific are coming back to the platform more often.

In a sense, the fact that Facebook usage isn’t in steep decline, should be viewed as a positive, given that many reports have indicated that the blue app is losing ground – though more recent insights from Meta suggest that it’s now gaining traction once again, at least in terms of time spent.

According to internal insights viewed by The Wall Street Journal, Meta did see an uptick in usage in Q4, largely driven by Reels consumption, which Meta chief Mark Zuckerberg sees as an indicator of the company’s evolving AI recommendation systems.

“Our community continues to grow and I’m pleased with the strong engagement across our apps. Facebook just reached the milestone of 2 billion daily actives. The progress we’re making on our AI discovery engine and Reels are major drivers of this. Beyond this, our management theme for 2023 is the ‘Year of Efficiency’ and we’re focused on becoming a stronger and more nimble organization.”

Yeah, when you’re essentially forced to cull 11k staff due to rising costs, you’re going to have to get more efficient.

Indeed, Meta’s revenue results are solid, but are still down on Q4 last year.

There’s still room to grow, but the broader financial squeeze, caused by the slowdown in ad spend, and reduced efficiency of some Meta ads products, has put more pressure on the company’s growth, which has led to lay-offs, and other re-assessments.

Within that, Meta has shut down various experiments, including its Portal home speaker device, its publisher funding agreements, its audio social tools, and its smart watch project (though apparently new images of its smart watch are now being circulated online, so maybe it’s back on the production menu?).

Meta has also delayed the launch of its coming AR glasses product, which had been scheduled for release in 2024, as part of its broad-reaching ‘Year of Efficiency’ push, which will see it hone its focus onto improving its AI discovery tools to maximize engagement in its apps, developing new ways to monetize messaging, and re-building its ad tools to reduce reliance on user data.

And, of course, the metaverse.

Which is still costing the company a heap of money – Meta’s Reality Labs unit reported a $4.28 billion operating loss for the quarter, bringing its total for 2022 to $13.72 billion.

Right now, betting everything on the metaverse seems problematic, with sales of VR headsets in decline year-over-year, and the company’s metaverse vision being lambasted by critics.

In the company’s defense, Meta has said that it’s going to take between five and ten years before we see any genuine traction on metaverse engagement. But still, with the amount the Zuck and Co. are throwing at VR development, it’s hard to see how it will all come together, at least at this stage.

But that’s the thing – the company’s metaverse focus is an all-in bet. It either works or it doesn’t, with no in-between, and we won’t have any real idea till at least 2027 as to whether it’s going to pan out in Meta’s favor.

By then, Zuckerberg will either be a genius or a cautionary tale. Right now, it’s easier to see the latter, but the former is just as, if not more likely, when viewed in full scope.

In terms of ads, Meta says that ad impressions in the quarter were up 23% year-over-year, as it continues to find new opportunities for ad placements. That could soon also see Meta showing more ads in Reels, and splitting the revenue with creators, which is reportedly being considered as a means to gain more traction with top creators.

The difficult thing on that front is that while people are spending more time on Facebook and Instagram, and watching more Reels clips, they’re not posting as much themselves, with creation and engagement in decline on both.

Is that a problem?

I mean, maybe not – if the aim is just to keep as many eyeballs attached to monetizable screens as possible, it might not be a big deal if people don’t post as often. But it will impact Meta’s ad targeting, as fewer posts means less data to go on in learning user preferences and interests.

Still, Meta’s AI ad matching systems are getting better, and maybe it doesn’t need people posting themselves as much as it used to in this respect. But it’s another element to watch in the broader Meta picture.

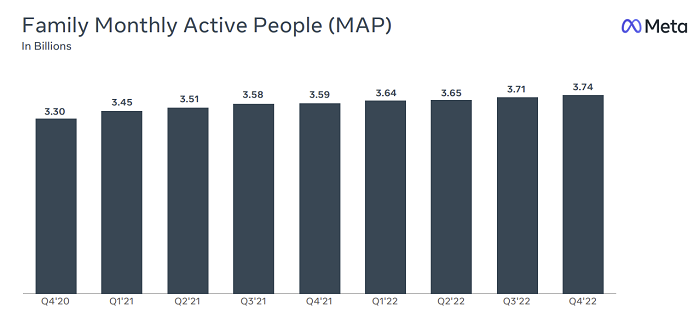

Also, Meta is closing on 4 billion monthly active users across its four apps.

For context, the current global population is 8 billion – so around half of all the people in the world are active on Facebook, Instagram, WhatsApp and/or Messenger.

Given that you’re also measuring kids and the elderly within this, that’s pretty amazing, and speaks to the sheer scope of the behemoth that Zuck and Co. have built.

And while Facebook isn’t the cool place to be anymore, and Instagram has lost ground to TikTok, clearly, both apps are still hugely popular, and play key roles in our interactive process.

Whatever our opinion on Meta or Zuckerberg, there’s no denying the vision or scope – and maybe that will, eventually, translate into the next stage, when the metaverse becomes a thing.

Or it doesn’t, and the company steadily declines. Either way, it’s going to be relevant for a long time yet.