Meta has shared another solid performance report, with the company posting a 25% year-over-year increase in revenue, and a massive 201% jump in net income year-over-year for the three month period.

Despite many questions around its Metaverse vision, as well as the apparent decline in popularity of Facebook, and its somewhat questionable early efforts to tap into the evolving AI race, Meta is still the powerhouse of the social media sector, and remains in a strong position to capitalize on emerging opportunities.

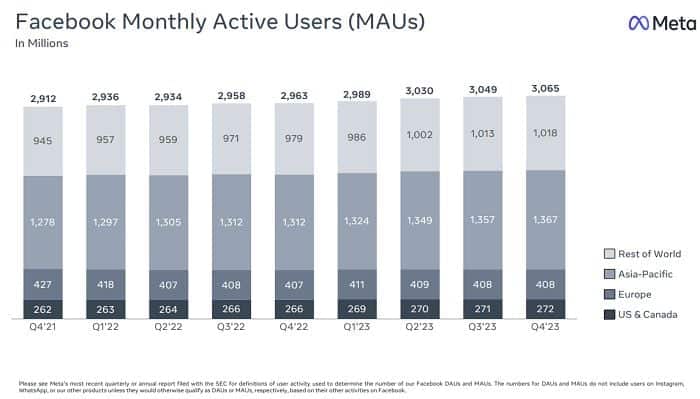

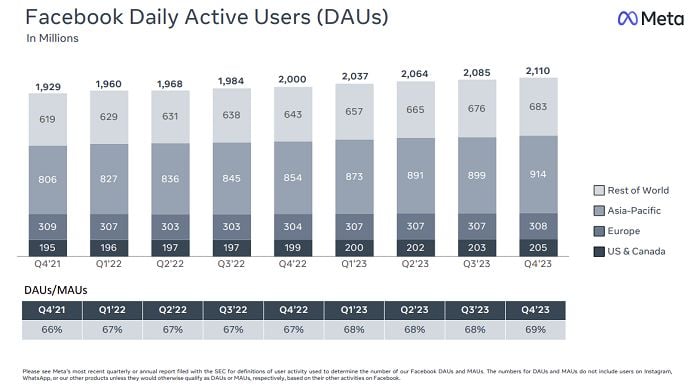

First off, on users, Facebook’s daily active user count rose to 2.11 billion on average for December, up 6% year-over-year.

Honestly, the fact that Facebook’s still adding users is amazing, as it has to be reaching saturation point in many markets. That’s especially true in North America, where Facebook still added 2 million more users.

The death of Facebook has been greatly exaggerated, and while I would also like to see time spent stats, in order to understand exactly how these 2 billion+ users are engaging in the app, Meta did report last year that user time on Facebook is also rising, as a result of more AI recommended content being injected into user feeds.

The platform remains a critical connector, and it’s also still growing at solid rates in emerging markets, which is also reflected in its monthly user stats.

The chart above shows that almost all of Facebook’s user growth is coming in the Asia Pacific and “Rest of World” segments. That’ll help to position the platform for further success as these markets evolve.

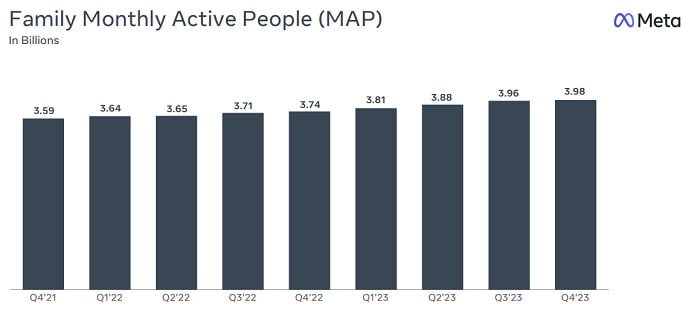

This could be the last time that we get Facebook-specific usage stats, with Meta CFO Susan Li confirming the company will only be sharing its collective Family user stats from now on. Meta’s Family user counts incorporate unique user data across Facebook, Instagram, Messenger, and WhatsApp.

It’s easy to lose sight of just how significant that figure is. The population of the entire world is around 8 billion, and with 1.4 billion people in China, where Meta’s apps are not available, that means that the majority of people who can access a Meta app are doing so on a regular basis.

Facebook remains a key ad consideration for this reason, because so many people check into the app every day to catch up on the latest news from friends and family. Sure, TikTok now takes up a lot of attention, but Meta’s platforms remain dominant in the overall market.

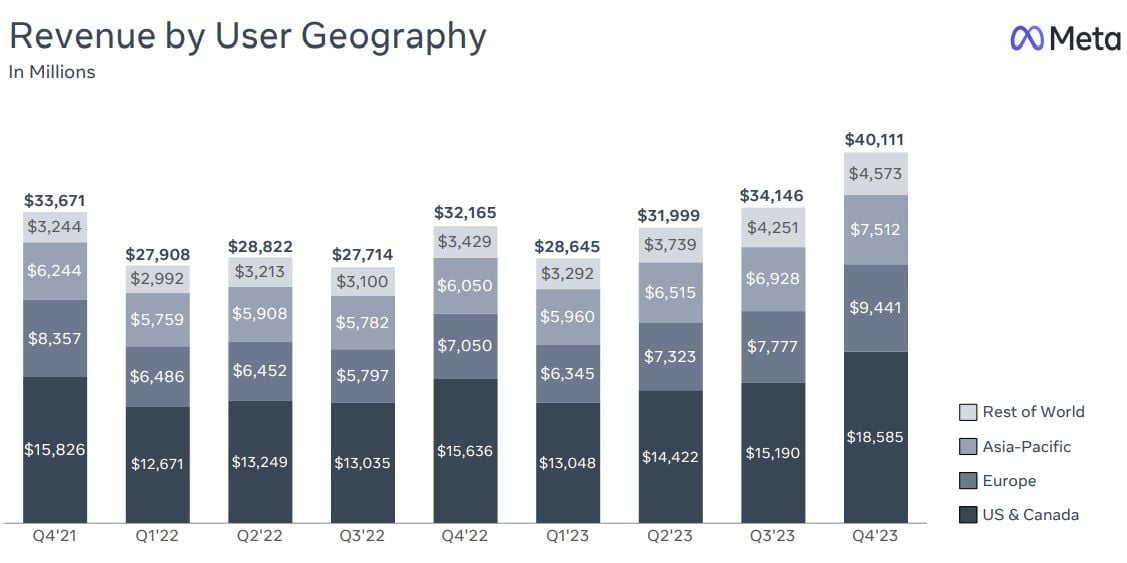

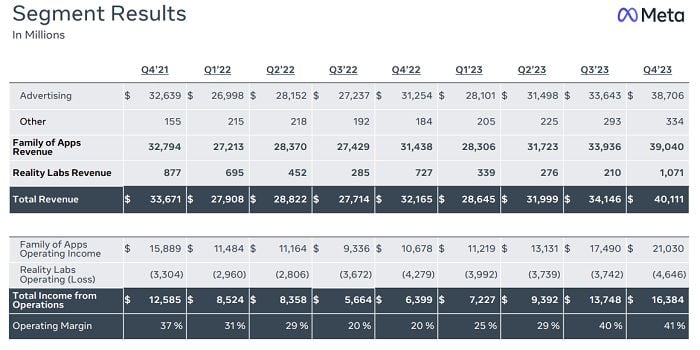

In terms of revenue, Meta bought in $40 billion for the quarter, bringing its total to $134 billion for the year. Meta’s advertising revenue in Q4 totaled $38.7 billion, up from $31.2 billion a year ago.

As you can see, Meta is still heavily reliant on the U.S. and European markets, but its other regions are developing, with its holiday results reflecting its ongoing ad system improvements, leading to increased advertiser demand.

Which leads to this interesting note for Facebook advertisers:

“In the fourth quarter of 2023, ad impressions delivered across our Family of Apps increased by 21% year-over-year and the average price per ad increased by 2% year-over-year. For the full year 2023, ad impressions increased by 28% year-over-year and the average price per ad decreased by 9% year-over-year.”

More ads, in more places means that the overall costs reduce, though it is worth noting that Meta saw an increase in average price per ad in Q4. That’s likely due to higher overall demand for the holidays, but still, worth noting.

On another front, its longer-term metaverse plan remains costly.

Meta did report an increase in sales from its Reality Labs VR division for the quarter, rising to $1.07 billion. But its cost of development remains high, with overall Reality Labs investment at $5.7 billion for the period.

That means that, in total, Meta spent over $17 billion on VR development for the full year, eclipsing its previous record of $13.7 billion in VR investment in 2022.

So while sales of its new Quest 3 headset are rising, and the latest version of its Ray Ban Stories glasses are gaining traction, Meta is still a long way from making money from its future bets.

But even so, there are positive signals, with Meta specifically noting that the increase in Reality Labs revenue was as a result of increased sales of Quest 3 units over the holiday season.

And with Meta also recently adding mobile connectivity for its metaverse environment, enabling non-VR users to engage in VR experiences, that should help to plant more seeds for the next stage, while Meta’s also eventually planning to integrate generative AI into its VR world building tools, which could further personalize its immersive offerings.

Also worth noting here is the variance in income in its non-advertising intake, which, in significant part, would reflect the performance of its Meta Verified subscription program.

Meta launched its paid verification package to U.S. users in March, so the results of those sales would be reflected in this element from Q2 onwards. Meta’s “Other” intake increased by over $100 million between Q2 and Q4, which could suggest that, at a basic estimate, Meta has sold around 6 million paid verification subscriptions.

Meta hasn’t released any specific info on this, but the rising numbers here suggest that its verification sales are in the millions. Which will help to bring even more money into its coffers, though that at 6 million, that would still only equate to less than 0.5% of its overall user base.

There are a lot of good signs for Meta in this report, so much so that even with the VR losses still being so high, its shares have seen a big boost, as positive sentiment around the company increases.

The storyline last year was that Meta was losing billions on Zuckerberg’s metaverse dream, but now, as that vision starts to clarify, and its ad business gets back on track, the narrative around Meta is changing once again.