Meta has published its latest performance update, which shows that while Meta’s platforms are still growing, its profit margins remain in a state, despite signs of recovery in some elements.

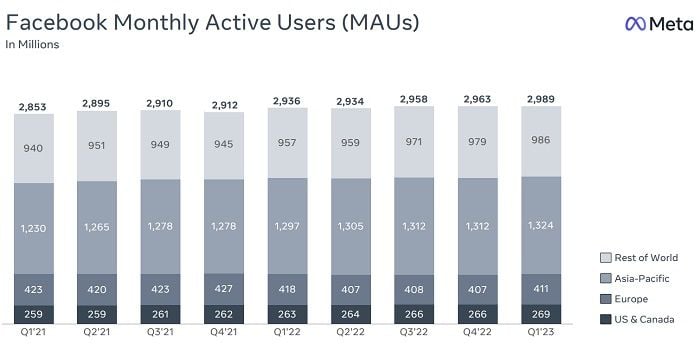

First off, on users, Facebook inched even closer to that 3 billion user milestone, reaching 2.99 billion monthly actives in Q1.

Interestingly, Meta saw relatively good growth in all markets, even the US, where it’s well-established, which is a positive endorsement of its renewed focus on highlighting more interesting content to users in-stream, as opposed to focusing on updates from friends and family.

Earlier this year, a leaked internal document showed that Facebook usage was indeed on the rise, with Reels, in particular, helping to maximize user engagement. The downside to that is that user created content – people posting their own updates – is in decline, though maximizing time spent remains the key focus for Meta, from a revenue perspective.

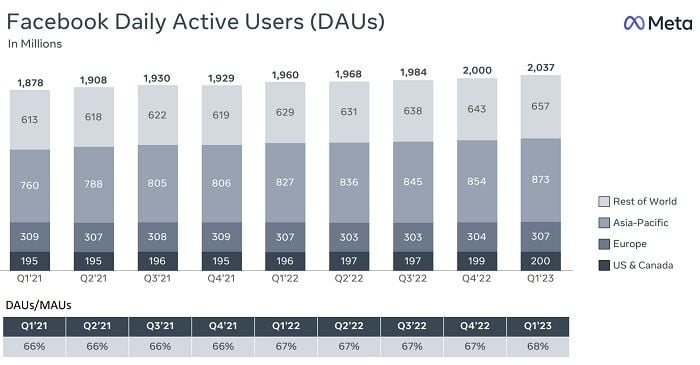

That same growth is also reflected in Facebook’s daily active user stats.

Note that the percentage of MAUs that are also DAUs is higher than it’s been in some time, which shows that more users are coming back to Facebook more often, which is a strong endorsement of its AI recommendations approach.

You may not like it, but seeing more recommended content in-stream is driving more Facebook usage, which will eventually present expanded advertising opportunities.

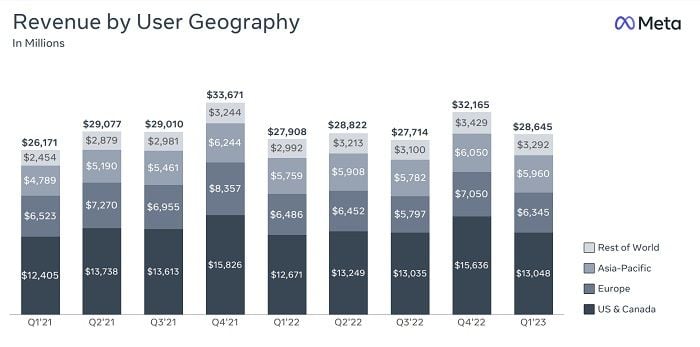

On that front, Meta’s revenue performance remained strong, bringing in $28.6 billion for the period, up 3% year-over-year.

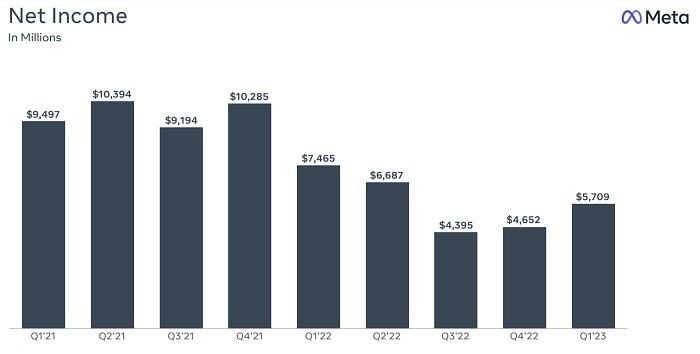

Which is good news for Meta investors – though this chart, not so much:

Meta’s net income – the money it actually brought in after expenses – is not looking great, partly due to the cost of payouts to staff that were fired in the period, and partly due to its ongoing investment in its VR projects, with Reality Labs, it’s VR division, still weighing down its overall research and development costs. Reality Labs recorded a $3.99 billion operating loss for the period, with the unit bringing in just $339 million for the quarter, a 50% year-over-year decline.

Logically, the broader metaverse backlash is not helping Meta shift VR headsets.

Despite this, Meta Chief Mark Zuckerberg has put a positive spin on the numbers:

“We had a good quarter and our community continues to grow. Our AI work is driving good results across our apps and business. We’re also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our long term vision.”

Indeed, on another AI element, various Facebook ad buyers have noted that Meta’s Advantage+ automation tools are generating much better results over time, and that’s a key reason why Meta’s ad business is regaining its footing – which is essential given the ongoing cost of building its metaverse experience.

Which is the key pain point. While Meta’s numbers do point to future hope of recovery, and new opportunities in new markets, it’s marrying that up with its outgoings that remains the big challenge.

Meta’s arguably navigating the most difficult period in its history, as it deals with reduced ad spend, due to the global economic impacts and changes to data tracking, while also negotiating rising backlash to its longer term metaverse plans.

The key issue here is that Meta needs to keep spending money – and lots of it – in order to build its ultimate metaverse vision, but rising pressures keep forcing it to squeeze costs, which has already seen the company lay off tens of thousands of staff as a result. More job cuts are likely on the way – which, in some ways, may be a good thing, as many of the big tech giants have become bloated throughout their evolution. But it will also have broader impacts, which may not be immediate, or even obvious. But they’ll essentially make Meta more vulnerable to competition, which has always been a keen focus for Zuck and his team.

That’s what’s also driving Zuck’s recent interest in AI, and developing new tools that align with the rising generative AI shift – because as the broader industry moves to align with this trend, Meta risks being left behind if it doesn’t also stay in touch. It would prefer to stay focused on the metaverse, and building its VR vision, but it also needs to remain connected to the latest key updates, which will again spread its resources even thinner in some areas.

But ultimately, the metaverse remains its north star – as evidenced by the massive infrastructure spend. Zuckerberg remains focused on building the next platform for digital connection, which he’s convinced will be in virtual environments.

Is he right? At this stage, the metaverse still seems like a flimsy concept – and really, Meta likely went too early on its VR push, which necessitated it going on the big stage without a finished product. But that doesn’t mean he’s wrong, nor that ultimately Meta won’t win out, as it continues to build new tools and processes that will eventually facilitate that next-level shift.

It doesn’t look that great right now, and Meta has repeatedly warned investors that it’s not going to look very good for some time. But at some stage, I do think there’ll be a bigger shift towards the metaverse, and Zuckerberg’s VR vision.

Really, it’ll only take one killer app, one amazing, workable example to build big interest in its emerging VR experience. Then sentiment will turn quickly, and Zuckerberg could well be hailed as the tech wunderkind once again.