Snap Inc. has published its latest performance update, showing a steady increase in active users, and a return to positive revenue growth. Though signs of what’s coming next for the app remain unclear, due to rising costs and increasing ad industry pressures.

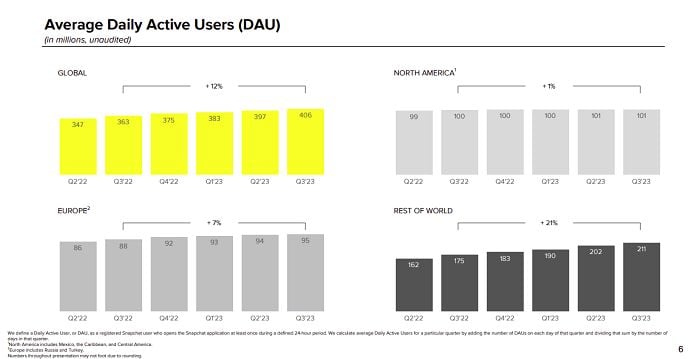

First off, on users. Snap’s daily active user count rose to 406 million, up 12% year-over-year.

It’s the first time that Snap has eclipsed 400 million users, which underlines the ongoing resilience and relevance of the app to its many users, though it is also worth noting that Snap’s still struggling to add users in the U.S., its key revenue market.

Still, the overall growth trend is a positive sign for future opportunities.

Youngsters, in particular, continue to use Snapchat as their connection platform of choice, with its more privacy-focused approach giving teens more peace of mind that their parents, and others, are not able to see their interactions. In this sense, it’s kind of like an expanded version of WhatsApp, which is the biggest messaging platform in the world, and it makes sense, then, that Snap continues to see solid usage.

Though it’s that expanded usage, beyond messaging, that Snapchat needs to boost in order to maximize its revenue potential.

On that front, Snap says that total time spent watching Spotlight content has increased by over 200% year-over-year, pointing to growing opportunities for Snap-specific programming.

Snap also says that its “My AI” AI-powered chatbot has been used by over 200 million people, who’ve submitted over 20 billion messages to the bot. Snap recently started testing sponsored links in My AI responses, providing expanded ad reach potential through the tool.

And a key trend of note:

“We are seeing more creators posting content to Snapchat, with nearly three times more public Stories posted in the US compared to Q3 2022.”

Snap’s been working to provide more incentive for creators to keep posting to the app, in order to keep their audiences coming back, and this is a good sign that its creator monetization programs are working to drive more interest, and ideally keep these top performers from moving to other apps.

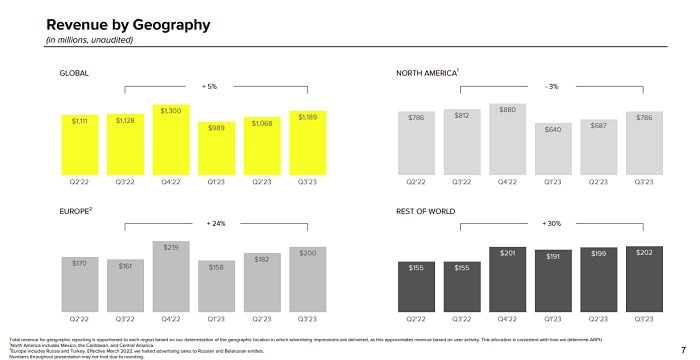

In terms of revenue, as noted, Snap returned to positive growth in Q3, increasing 5% year-over-year to $1.189 billion.

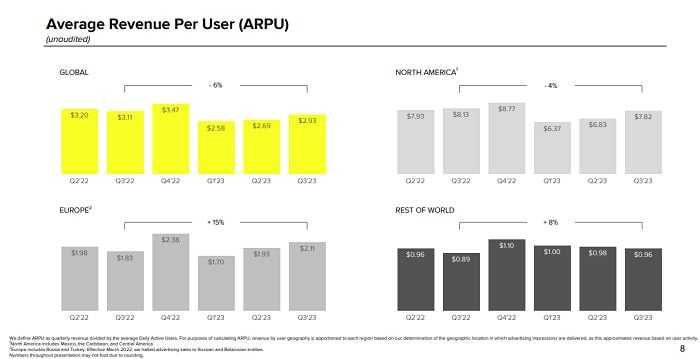

As you can see in these charts, Snap is still largely reliant on North America for its income, even though the majority of its user growth is coming from developing markets.

That remains an element of concern, as to when Snap will be able to more effectively monetize these other regions, where it actually lost ground in Q3.

Snap says that the main driver of its return to revenue growth has been the development of its machine learning and optimization processes, enabling better ad targeting. Snap also launched new ad products, like its “Total Takeover solution”, a more high-end offering to lure big name brands.

On another front, Snapchat+, has continued to grow, passing 5 million subscribers in Q3.

Though this remains a concern:

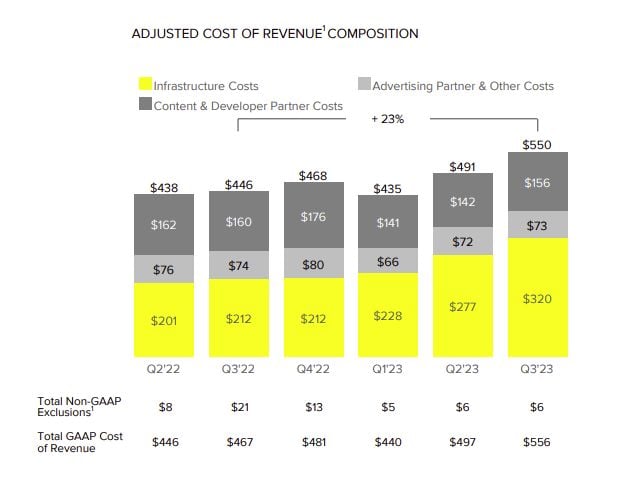

Snap’s infrastructure costs, largely driven by its cloud storage expenses, continue to rise. Snap is working to reduce this, through revised deals with Amazon and Google. But as it continues to add users, there will always be a level of crunch at the top end, where capacity needs to be maintained, and income, ideally, needs to rise in-step.

Which remains the key challenge for Snap.

Despite increasing its overall audience, it’s been an increasingly difficult time for the company, with Apple’s iOS 14 privacy update still impacting its ad business, while the broader slowdown in marketing spend has further dampened its prospects.

Indeed, Amazon, one of Snap’s biggest advertisers, significantly cut its ad spend this year, which is one of various reasons why Snap has been forced to cut hundreds of staff, and abandon some of its more speculative projects.

Among them was Snap’s ARES program, which aimed to facilitate partnerships with retailers and other third-party organizations on custom AR integrations, using Snap’s industry leading AR expertise. That seems like an area ripe with opportunity, especially when you also consider the development of AR glasses, which will become commercially available within the next few years.

Businesses will be looking for more AR providers, a role that Snap seems perfect to fulfill. But Snap shut down ARES last month due to rising cost pressures.

Snap’s also reportedly scaled back its development of AR-enabled Spectacles, which could be a big blow to its future potential, as Apple and Meta muscle into the space.

More recently, however, Snap CEO Evan Spiegel has provided a more positive outlook, noting that Snapchat’s aiming to reach 475 million active users in 2024, an addition of 69 million on current levels, while also increasing ad revenue by 20%.

Snap did clarify, however, that these are ambitious, stretch targets, and are not necessarily realistic KPIs, as such.

Which leaves Snap in a somewhat uncertain position. Right now, the app is still growing, though not as quickly as analysts would like, and it does have a lot of potential on the AR development front.

But will Snap have the resources to capitalize on this, or will it eventually be overtaken by competitors who are rapidly pushing into the AR space?

It’s core social elements remain very sticky for your younger audiences, so it seems that Snap will be viable for some time yet. But growth is the bigger question, and how Snap can expand upon its current audience niche, and effectively monetize such, remains unclear.

But Snap has indeed established a niche, and still has various, smaller growth options on this front.

There are challenges, but there are also various positive signs within the broader picture.