While user interest thus far has been relatively low, TikTok continues to push ahead with its live-stream commerce initiatives, in the hopes that it can replicate the success that it’s seen with such in China in other markets around the world.

After scaling back its live commerce push in Europe, due to various teething problems TikTok’s now taking a new approach in the US, where it will reportedly partner with established live shopping network TalkShopLive to boost awareness of its shopping broadcasts.

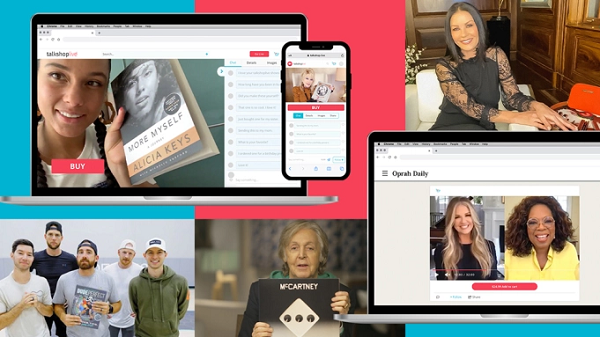

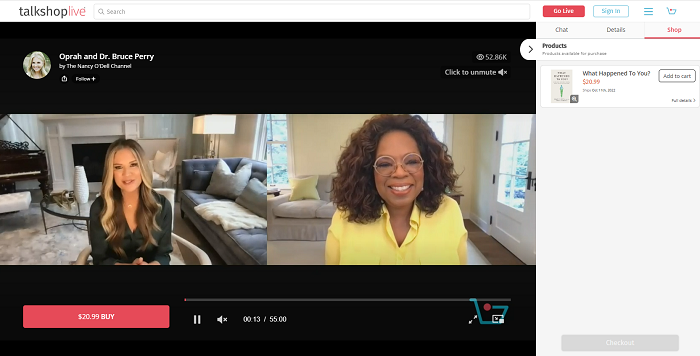

TalkShopLive hosts an expanding variety of live shopping streams, covering a range of topics and product categories, and is steadily becoming a popular online product discovery and shopping destination. The platform doesn’t share specific user numbers, but it did note last year that sales made via TalkShopLive broadcasts were increasing at a rate of around 85% month-over-month.

That’s largely been led by an array of popular celebrities signing on to sell goods via the app, including Oprah Winfrey, Paul McCartney, Dolly Parton, Alicia Keys and more.

TikTok will presumably look to form a new partnership with TalkShopLive that will see its own live shopping broadcasts cross-posted to the platform, which would then help it reach more engaged, active shoppers, and further promote its live-stream commerce offerings to this group.

At the same time, TikTok’s also partnering with various influencer agencies to get more popular creators on board with its live shopping tools.

As reported by Rest of World:

“TikTok is partnering with influencer agencies around the world, hoping to build a robust live community with a culture of gifting that can become the app’s next revenue stream. Rest of World spoke to agents based in China, the Middle East, the U.S., and the U.K. — all of whom confirmed that they’re working with TikTok to train their community in the best way to gain an audience, and solicit gifts.”

So on one hand, TikTok’s looking to maximize reach to people who are looking to shop, as opposed to those coming to its app for entertainment, while on the other, it’s working with influencers to help them understand how they can use live shopping broadcasts to make more money in the app.

That’s a much different approach to how TikTok looked to build its live shopping team in the UK, with its aggressive approach to promoting the option eventually turning away both potential partners and shoppers alike.

TikTok has, however, seen success with live shopping in Asian markets, with its live-stream commerce tools seeing growth in Thailand, Malaysia and Vietnam.

It’s just the western markets that need to catch up – but will live-stream commerce ever catch on in non-Asian regions? And if not, what’s the difference between the two approaches that’s seen it go massive with some audiences, but flop for others?

Live-stream commerce is huge in China, where the local version of TikTok, called Douyin, has become a key conduit in helping connect streamers to revenue opportunities.

That spells opportunity for social apps – but thus far, TikTok, Facebook, and YouTube have all been forced to dial back their live-stream commerce efforts based on lukewarm audience response.

But TikTok needs to make it happen. The challenge for TikTok is that it can’t insert pre and mid-roll ads into its short video clips, which makes creator revenue share more difficult, as it can’t then directly attribute each ad to the relative performance of a creators’ clip.

That’s not to say that TikTok’s not making money – TikTok brought in $990 million in revenue in Europe alone last year. But without a system to pass on a relevant percentage of that income to creators, eventually, questions will get asked, and like Vine before it, the top stars will want to know why TikTok is making billions on the back of their videos, while they’re fed comparatively tiny amounts from the same.

Again, it’s live-stream commerce that’s been TikTok’s savior in China.

Douyin’, generated $119 billion worth of product sales via live broadcasts in 2021, a 7x increase year-over-year, while the number of users engaging with eCommerce live-streams exceeded 384 million, close to half of the platform’s user base.

Overall, the Chinese live-stream commerce sector brought in over $300 billion in 2021, which is almost half of the entire US retail eCommerce market.

It makes sense, then, why TikTok is so keen to ‘make fetch happen’ in western nations as well – but increasingly, it seems as though western users just aren’t interested in buying from streamers online.

The Middle East is showing promise. According to one report, some agencies are gaining traction with popular streamers in the Middle East, which shows that this is not an Asia-only trend. That’s likely buoyed TikTok’s hopes, which may be part of this new push, but it still has its work cut out for it in getting widespread take-up in more regions.

It is possible, of course, and it may still become a bigger thing at some stage. But right now, it’s hard to see how TikTok’s going to get over the initial adoption hump, and gain momentum with its live-stream commerce offerings.

But via initiatives like these, it might, and if it can, that could be a huge boost for TikTok’s broader expansion plans. Because with YouTube gaining traction with Shorts, and adding its own monetization pathway with Shorts ads, you can bet that the top creators are looking in YouTube’s direction as a means to make real money from their creativity.

In essence, TikTok needs live commerce to become a transferable trend – but whether it can make it so remains the key question.

But if it can, that will open up a range of new considerations, for many brands.